Looking for a Hong Kong online business bank account that you can connect your Paypal and Stripe / Braintree merchant account to?

Wouldn’t that be amazing, without the utter nightmare Hong Kong business owners are going through now begging these archaic banks to allow them to deposit their money?

We here at Global From Asia know the pain that you, our entrepreneurs and hard working global business owners have been going through. As digital nomads; e-commerce sellers and FBA business owners, we feel the pain ourselves. This is why our clients for our corporate services enjoy working with us. We understand you.

And we also know that the biggest pain point for almost 2 years now has been – such a basic need – a business account solution in Hong Kong.

One with credit cards for you and your staff. Or, one that can link to your Paypal and Stripe.

We’ve been testing so many and been talking to so many – and today we’ll be talking about one we’ve been following for years.

Neat.HK: a Multi-currency Wallet Alternative for Online Business Owners

So I am focusing today on their business product – Neat Business Account (technically not a bank, but a HK banking alternative). I know exactly what you guys are looking for – and here is a list of their features:

Unique Account / IBAN number

You will have your own dedicated account number with Standard Chartered. This isn’t like some other solutions where you have a sub-account and need to put in your TT (telegraphic transfer) banking notes your sub-account number. This is a dedicated account number ONLY FOR YOU and your business. I’m not sure the technical way they got this – but this is the amazing part – that allows you to do the following:

Connect /Verify your Paypal Hong Kong

We have a Paypal Hong Kong guide that gets a lot of attention on how to verify your Paypal. You need a “unique” or dedicated IBAN number. This Neat Hong Kong business solution gives you that – unlike other online / virtual banking solutions I have come across.

Connect / Verify your Stripe HK or Braintree merchant account

Similar to Paypal, you need a unique bank account in your company name in order to get Stripe and any other merchant account setup. Don’t worry – this will work here too. We have a full list of merchant account comparison here that is popular as well.

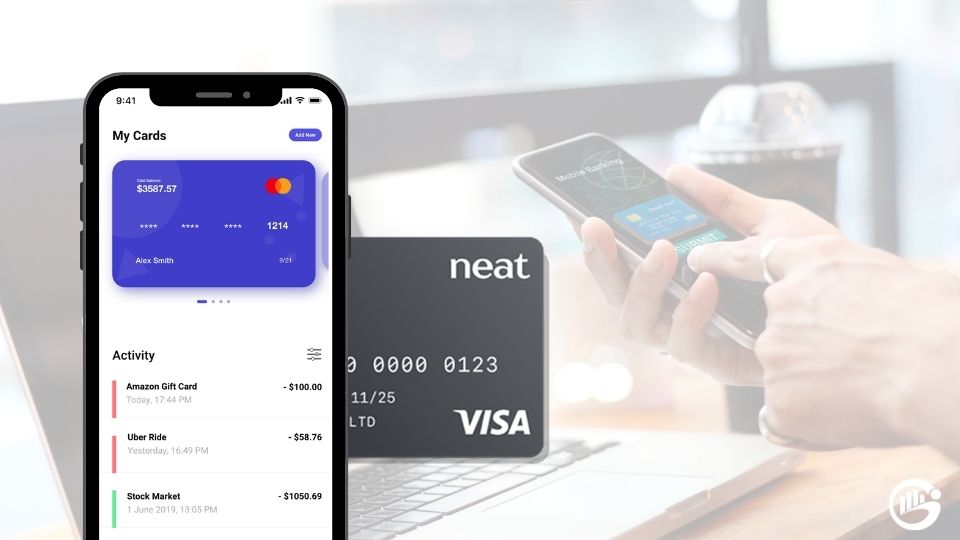

Issue Company credit cards

You can order credit cards! Yes, finally! You can see a company credit card in your company name here in HK without having to sign your life away and deposit your life savings! Seriously, readers know it is hard to get a Hong Kong credit card.

Deposit paper checks

Many ask how to deposit checks (yes, Hong Kong does still use quite a bit of paper checks). This works too. You need to go to Standard Chartered Bank, in person and deposit. You can’t do it at the ATM.

English, Online Banking

And of course, it has online banking. In english too! Well, that is actually something we need to write as a bullet point, as some banks we are forced to work with in our partner corporate services agency, don’t have online banking. Or, it takes forever to get issued.

I think this has huge potential, and I may finally be able to rest well at night when we get new clients for a Hong Kong company (read our Hong Kong registration guide here) setup and yes, their request to get a local HK bank solution (technically we can’t say bank, but instead banking alternative).

What’s new with Neat HK in 2020?

There are recent updates issued by Neat HK that will be helpful to the users of this solution and also to those looking for a solution to their business’s financial needs. Here are the said updates:

- Partnership with Visa

- Neat Account

A lot have been waiting for this and this comes as a very exciting news. For us, this will mean added perks. Starting December 2020 then, Neat will be issuing Visa cards instead of Mastercards.

The Terms and Conditions for affiliates were updated to include the new terminology when referring to Neat. “Business account” and “Bank account” are no longer valid terms. Instead, the term Neat Account shall be used. This will be more identifying of the kind of solution that you are using.

The changes in Neat HK were meant to improve your whole experience. But one thing that they are consistent with is their aim to keep it simple, for you to save time and money and be stress-free so you can focus on growing your business.

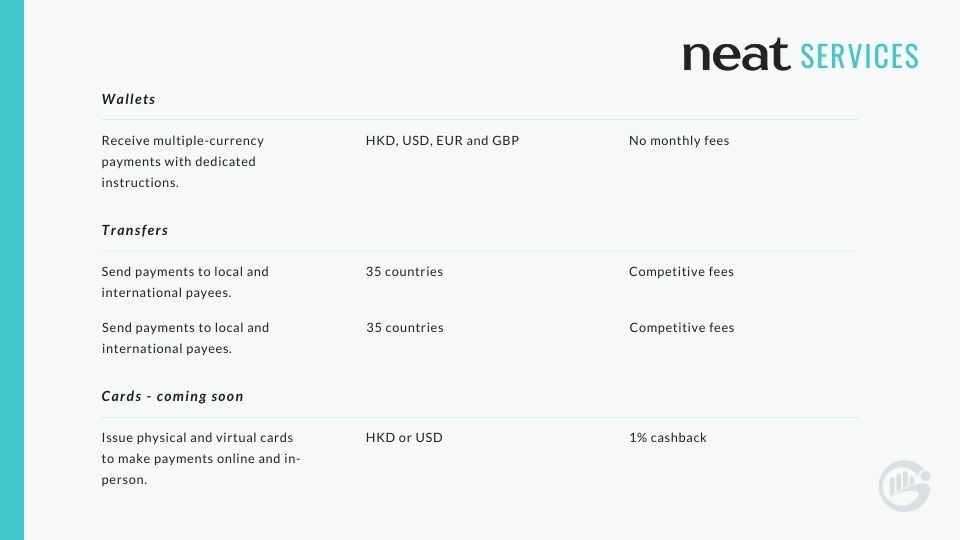

These are the services that they are currently offering based on the new service introduction brochure that they sent out:

Wallet

Receive multiple-currency payments with dedicated instructions | HKD, USD, EUR, and GBP | No monthly fees |

Transfers

Send payments to local and international payees | 35 countries | Competitive Fees |

Exchange funds between supported currencies | HKD, USD, EUR, and GBP | Low Fees |

Cards-coming soon

Issue physical and virtual cards to make payments online and in-person | HKD or USD | 1% cashback |

A Big Update From Neat HK – 2019

Neat has been undergoing some major improvements especially in customer support. In their email that we will show below, they advised that they will be upgrading their customer support software to Zendesk.

Of course, there will be a bit of inconvenience that can be experienced during the upgrade but all that is being addressed and fixed by Neat. To better understand what Neat is trying to do and what changes we will be seeing after, here’s their advice:

Thanks for being a Neat customer.Over the past few months, we’ve started making changes in order to improve our customer support experience, and one of the most significant will be taking place over the next few weeks.

We are aware that currently we are not always providing the experience that we strive to deliver, and you aren’t always hearing back from us as soon as you’d like.

In order to provide quicker response times and higher customer satisfaction, we’ll be upgrading our customer support software to Zendesk.

As we migrate our email and chat system, our chat system will be unavailable from tomorrow (Nov 6) until the end of the year.

While our chat is offline, our email support will of course still be available (support@neat.hk for personal cards and business@neat.hk for business account queries).

Any outstanding chat queries will be converted to email tickets, which we’ll of course be following up with promptly over email.

What will change?

- Over the next 2 months we will clear our backlog of email queries, and by the end of November, we aim for our first response time to always be within 1 business day for any email queries.

- The system upgrade is going to help us better keep on top of the queries that come our way, and give each customer that comes through chat an improved experience.

To account for the pause in chat, our customer support agents are doubling down on email queries, so we’ll do our best to give a prompt response to any support you may need.

We’re also hiring additional customer support agents, if you have any referrals feel free to send them our way here.

We’re working hard to improve our customer support, and we hope you’ll experience the difference. Please let us know if you have any questions in the meantime!

Thanks,

The Neat Team

Big Plus – Don’t Need To Come To Hong Kong To Apply

Here is the big, big one that I know our readers at Global From Asia will love. You can apply and get approved online. So now, once we get this moving smoother, we can help clients open a HK company and HK bank financial solution without needing to fly here.

Can you say…

Game changer!?!

Wow, Hong Kong may be back open for business. It’s been a rocky road since March 2016 but we may be out of the ice age and entering normal business climate.

How I Came Across Neat

I met David Rosa, the founder of Neat hk a couple years ago (approximately early/mid 2016) when they were in their early stages. He visited me in my TST office and we chatted about the struggles of banking in Hong Kong and Asia in general. I had been doing my podcast already for a couple years then and was helping clients open up companies and banking. I explained the utter nightmare it was to beg a bank like HSBC to please let us deposit money with them.

At that time Neat was focused on the consumer banking side (individual accounts) but he said once that was going he’d work on their business banking solution and let me know.

I also have gotten to know others on his team, and he had been merging with other local Hong Kong fintech startups I had been following.

It’s true – Global From Asia is a great blog and media source for Fintech in Hong Kong and Asia. So I am always getting startups, trying to solve this nightmare banking issue, find me and send me their new products and solutions.

It is my biggest pleasure to be able to blog about this and give everyone hope. There is light at the end of the tunnel and I really hope this disrupts these archaic banks who destroy small business owners’ livelihood.

Let’s give power back to the SME and let’s leverage online banking – who needs to visit a corporate banking branch anyway?

Can You Trust This New Fintech Startup?

As I have been telling clients about this new banking solution – some are still a bit nervous. A startup holding your funds is a big risk, not as simple as a social media app where you share what you ate for dinner.

True, I always have to disclose you need to use any financial solution at your own risk. But they are recognized in Hong Kong as an accredited Fintech company and work inside Cyberport. I should get him on the podcast as well (update: we got them founders on the podcast, see below!).

Check Out Our GFA Podcast With the Neat Founders

We had a great chance to have co-founders David Rosa and Igor Wos on our very own podcast – check the Story of Neat HK and enjoy!

A Visit to the Neat Hong Kong Office

Andre in the community went to their office and posted this in our wechat group and agreed for us to share this here:

I got the opportunity to go to Neat’s office in Wanchai and sat down with Andrew Ngo, head of Customer Support. Everything below is my opinion and I am not affiliated with Neat in any way, other than being a customer. So I am just trying to be helpful for you all. As usual if you have issues with Neat contact them via their support channels.

I was overall very impressed with Andrew’s transparent and honest responses. Andrew has been in the customer relationship and customer service industry for many years, including within Telstra (Australian Telecom Company), Citibank and even Uber. He definitely knows what he is doing and is pro-customer. He completely understands the frustrations of business owners and of the bugs and issues with Neat. He recognises that a lot of things need to be changed for customer satisfaction and so the company can grow, survive and thrive.

Andrew has only been with Neat for 3 months and there were major issues with the previous person not being a ‘connector’. For example, if there were certain issues, the information would not be relayed to the correct departments hence issues kept re-occurring. Andrew is implementing many changes, but it just cannot be done overnight.

I felt reassured and positive that a lot of things are being rectified and that Andrew can make a real difference.

Some points that were clarified

- Accounts being closed:

- New virtual account numbers:

- Business account monthly fees:

- Lack of information on updates:

- Customer service issues:

- Customer relationship managers:

Standard Chartered closed a number of accounts due to compliance issues, this had nothing to with Neat. Also, if you submitted a KYC stating your company does ‘YYYY’ industry yet you really do ‘JJJJ’, they will find out through a background check. This is just standard procedures in HK, don’t think using a virtual account means you don’t need to follow any rules or laws. Banks and financial institutions in HK try to cover themselves anyway possible.

Some old customers were transferred to new virtual account numbers, because it is a new banking partner a new KYC process had to be completed, hence some people could not keep their accounts open and why some customers were being asked to submit business information again.

the actual date the account fees will start is TBA as Andrew wants any bugs or common issues too be ironed out first, at this point it is November 1st but may be pushed forward.

before doing changes (for example SCB to DBS) Neat has stated they do send e-mails but some e-mails may go to spam boxes. I suggested Neat use a social media account for example on Twitter where they state any updates, changes and if there is any backlog or delays occurring. This would give all customers an external view to what is going on internally.

unless you were to be swearing and abusive to customer service staff, there is no ‘banning’ or ‘blocking’. Customer queries will all be dealt with but due to limitations in the current CS software (which Neat has a 2 year contract with) there are some issues in how Chat/Tickets are arranged and sorted out. This is something which Andrew has a huge issue with and he wants to implement a whole new system.

this is something that may be possible in the future. But as Andrew says, he sees all customers as equal so why should some get a dedicated account manager and some not.

- Lack of information and resources on the website:

- TFP prefix:

- Issues for some companies with dashes:

- Bug:

- EUR and GBP accounts:

- Transfers being delayed from overseas:

- Delays with Stripe or PayPal:

- Payments being flagged:

the ‘SUPPORT/FAQ’ part of the website is going to under-go a massive transformation so that it eliminates the need to ask basic questions. The issue now is that the ‘SUPPORT/FAQ’ is so empty and bare bones that you almost always need to send a e-mail which is frustrating for the customer and means Neat uses up resources answering questions that could already have been answered. I suggested they also add Tutorials and articles on all the most frequently asked questions / issues.

Neat hopes to have no prefix in the future, this is a on-going discussion with banking partners but is so far not possible. It seems all virtual accounts in HK are the same.

like above, this is something Neat wants to resolve in the future, but at present, no timeframe.

sometimes bugs occur in the app and website, often this is stand-alone bugs for individual users, not platform wide. If you do have any bugs make sure to contact customer service and give as much information as possible so they can pass it onto the tech team.

payments must come from banks within SEPA, other transfers will be rejected. This is the policy of the partner company, not Neat.

in most cases it has been found some information was not entered correctly, for example, beneficiary name not including the TFP prefix, bank or branch code being incorrect, etc. If there is some issues, contact Neat support and show them the transfer receipt from the customer/source of funds. If everything is correct then maybe there is some bug.

sometimes these payments need to be manually approved due to the TFP prefix not being in the beneficiary name. Ensure the virtual account numbers are correct.

like any financial provider Neat has to follow HKMA policies. If unusual payments do come in the system may flag it and someone may ask for more information. This is industry standard. If you were to say receive large deposits all at once, there should be no issue unless it is suspicious. Like any bank or financial company, if you’re doing nothing wrong you should be fine.

Ready to go and get this new Hong Kong Business Banking solution? How To Signup?

So I probably have you on the edge of your seat (I hope!) and I have you excited to apply.

If you are starving and about to die of starvation as you have a HK company already and just need a freaking bank account, then this is a great solution for you. You can browse over to Neat Business Account and apply (update: Neat is out of closed beta, and also technically Neat is not a bank – but a current account and banking alternative). We are a Neat Business Service Provider Partner and have a special relationship with them. We can help you get expedited, prioritized service but that is only if you’re a client of our corporate services division (Unipro). Then, you can talk to our client services department to get that going.

Don’t have a HK company yet and now feeling more confident you can build one and get a banking alternative account for it? Then let’s work together. Check out our HKVIP package and let’s get down to business.

This may have just reopened the doors to doing business in Hong Kong for online business owners. That plus the corporate tax rate has been dropped to 8.25% (from 16.5%) for SMEs with less than 2 million HKD in revenue. Ice age in HK may be past us. Let’s hope and we will keep you updated as this progresses.

Ears On The Ground

have you succeeded with HSBC ? [Surprise] A lot of variables will come into play, especially fiscal residency and company’s “establishment” location. Generally speaking, will be harder for countries like me France to apply in today’s banking conditions. Anyways, NEAT business is good although they are launching and still developing.However pay attention -> they have merchant limits as they are NOT a bank, they can only hold funds under a 2million HKD limit. This means, if you generate large amounts of revenue, you won’t be able to store all of your funds with NEAT, you will need like a traditional bank account for savings for example. I currently work it out this way :

1/ I use sendwyre to do as much as I can with supplier payments and other online payments then send the remaining to NEAT

2/ I use NEAT for other purposes like the mastercard to purchase stuff online, also will do HK based transactions or other operational stuff I may need on a week to week basis.

3/ I have a traditional bank account I was able to open after almost a year of issues and 3 banks denied. This one is not being used right now and I unfortunately pay fees to keep it opened. However the aim is to keep this bank account in order to have a back up plan in case NEAT goes bad + it allows me to grow my business where when I will cross the 2million HKD in balance on NEAT, I start sending over to my bank. Remember -> you may have sometimes over 2million HKD for just couple weeks , in that case NEAT won’t accept your funds. So long term wise, you need a traditional bank too and play around those limits.

mobile online forum

Input from Neat, March 2018

“Ok guys so answers from neat: still no multi currency accounts, cannot currently deposit cash, to withdraw cash standard neat charge of 2.5% is charged, the main partner bank is standard chartered. So currently it’s best just for users purely doing online business.”Andre

Can I wire in USD or other foreign currencies?

Yes, you can wire incoming currencies no problem.

Can we transfer money to EU banks?

For wiring out, you can only send money within HK. But you can use a cross border payment company such as GoRemit HK.

Check our blog on cross border payment companies.

What’s the account limits?

2,000,000 HKD (a bit over $250,000 US dollar) as of March 2018.

A question from a Client

“I have a question, we set up the neat account and everything went smoothly and the account is open and active now.however, it shows the account only accepts incoming wire.

Is there anyway you can help us with that? I tried looking for information on how to contact the bank directly but they only have a q & a with 15 questions.

the main reason we wanted an account was to pay our supplier in China to expedite the process of importing our product to USA. Can you please give me some information and also if you can let me know how we can open account with a better bank.”

We suggest using a cross border payment service provider in the middle.

Questions from a GFA Client

I recently tried to open a Neat.hk account, but they are only limited to HK company. So if I open a Hong Kong company using the services from GFA, and then open a Neat.hk account, will I be able to transfer money from my U.S. banks to Neat? For tax purposes, I would like to show that I am buying inventory from my HK company and importing that to my U.S. company. Can I do that? Is it easy to transfer money that way?

I will then buy inventory from my Chinese supplier using my Neat account. Is it possible to transfer money from Neat to their HSBC Hong Kong banks and also to their China Banks?

GFA Answer: Neat only currently allows you to send money to other HK banks. BUT - the solution has been to use a cross border payment solution such as AureliaPay - Go Remit to send from HK to overseas such as China.

Information You’ll Need to Apply

Here is a copy/paste of their latest application form

This form collects information about your company so that we can complete the application without the need to travel and visit our office.

We will gather information about:

- Your company

- Directors

- Shareholders

- Ultimate Beneficial Owners (natural persons who ultimately own or control the company)

In order to complete the application you will need the following documents:

- Valid Business Registration Certificate - example - (or equivalent for companies not incorporated in Hong Kong)” - example

- Photo ID of Directors and Ultimate Beneficial Owners

Neat HK will also help you to generate a Board Resolution that authorise you or one of the directors to open an account with us on behalf of your company. The form is pre-filled and requires just a signature.

NOTE: Please be as accurate as possible - this will speed up the review process and increase the chances of your application being successful.

P.S. You can save your application work at any time and come back to it later on. Just click on the "Save" button and input your email.

Input from Neat, March 2018

Here’s an update from Andre in our GFA Community Wechat group on the Neat bank situation for HK:

Ok guys so answers from neat: still no multi currency accounts, cannot currently deposit cash, to withdraw cash standard neat charge of 2.5% is charged, the main partner bank is standard chartered. So currently it’s best just for users purely doing online business.Andre

What is Neat HK?

Neat is a mobile current account that makes everything accessible and at ease. It only takes 10 minutes of your time to have a Neat account. You do not have to worry with your local and international purchase, with over 50 currencies available with Neat, they got you covered!

With Neat, you can manage your money anywhere, receive salary and make payments, and send money to your friends.

There is also an available Neat Card for free. It is a prepaid MasterCard issued by ePaylinks. There is a new update in year 2020 that Neat will stop issuing Mastercard and will instead issue Visa cards. Check the update here. Browse the following incurring fee before you avail a Neat card.

What are the fees needed to acquire Neat HK?

There are no reflected monthly or annual fees and for acquiring a Neat Prepaid Mastercard. There is a new update in year 2020 that Neat will stop issuing Mastercard and will instead issue Visa cards. Check the update here

However, a lost or stolen card of Neat HK will cost HK $50 for a card replacement.

Each ATM withdrawal with a minimum fee of HK $25 will have an incurring fee of $25. Transaction refund is for HK$4. Those merchants in Hong Kong who are under an international brand is included with 1.5% fee in HKD Transaction Foreign Merchant. When you inquire for your balance on an ATM, there is a fee of HK $4.

Also, a consecutive six months of inactivity will be charged HK$12.5 a month. Unless, the balance is zero.

How to get the Neat HK application?

Neat application is available for both iOS and Android devices. You can just download the app from their respective app stores.

How to get a Neat HK Card?

To have a Neat HK Card, complete the registration process on the Neat Application. The only requirement you need is a passport or a Hong Kong Identity Card.

Is there a Business Account offered by Neat HK?

Yes, there is a current business account offered. There are a lot of benefits for your business when you use Neat HK for your business!

- An increase in productivity will be achieved with Neat Business HK. They offer you tools that can help you operate your business efficiently. The dashboard can give you the insight and control of the progress of your business finances.

- Just like the personal subscription, business account is a quick setup. You have the access of your bank account anywhere and anytime.

- The offered business account is timely. There are integrated features that automatically organize admin tasks. This feature will help you focus more on your business.

- You will be assigned with a dedicated Hong Kong bank account number. Neat supports many e-commerce platforms. This allows you to receive payments and manage disbursements.

- More so, business accounts offers a feature that can easily pay invoices and employees.

- There is an expense card available that enables your employees to make purchases online and offline, and withdraw cash at ATMs.

- Now, lost receipts are not a problem anymore. Its feature has the ability to add pictures of receipt.

This business account is still developing. There are two features to be added on its update: powerful reporting and

automated accounting

How to apply for Business Account?

Neat Business Application

You have to fill out the Neat Business Application, information about your company are collected. The catch is, you do not have to travel to Hong Kong to apply for a business account. Filling out this application will only take you 10 to 15 minutes. If you have some things to do, you can save the application any time and finish it later.

Information regarding the company, the ultimate beneficial owners, shareholders, and directors. The said ultimate beneficial owners are those who naturally owns or controls the company.

The following documents are needed to complete the business application:

- Valid Business Registration Certificate (see example)

- Passport of Directors and Ultimate Beneficial Owners

Neat also helps you produce a Board Resolution that will authorize you or one of the company directors to open a business account in behalf of the company. The form will be pre-filled and it will only require a signature.

Before you plan to fill up a business account application with Neat HK, please check whether your company meets the compliance requirements.

List of Restricted Nationalities

- Afghanistan

- Bosnia and Herzegovina

- Central African Republic

- Democratic People’s Republic of Korea

- Democratic Republic of the Congo

- Eritrea

- Guyana

- Iran

- Iraq

- Lao People’s Democratic Republic (Laos)

- Lebanon

- Libya

- Somalia

- Sudan

- Syria

- Uganda

- Vanuatu

- Yemen

List of Restricted Industries

- Adult related

- Antique Dealers

- Arms Dealers

- Auctioneers

- Cryptocurrency Dealers

- Defense System

- Foreign Exchange Dealers

- Gambling and Casino

- Jewel, Gems, and Precious Metals Dealers

- Nuclear Power

- Pawn Shops

- Plane Dealers

- Products and Services Illegal under Hong Kong Law

- Pyramid Selling Schemes

- Stock Securities Companies

If you think you meet the compliance requirements, start filling out the application.

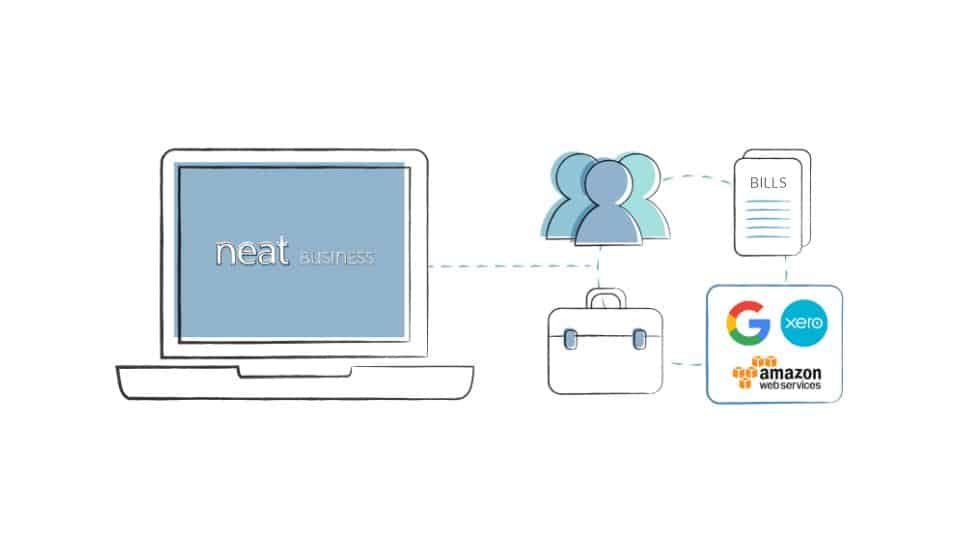

What are the features of Neat Business?

Neat Business is yet only dedicated to Hong Kong dollars current account and a local bank account number.

However, the company plans to offer a multi-currency account wherein it will support a multi-currency account.

Payments made from anywhere around the world will be received via the business account. Any outgoing payments from local third-party banks in Hong Kong are also supported. However, the outgoing payments to international banks is still about to be offered.

It is also planned that Neat HK and Xero Cloud accounting should be integrated. This is to enhance online banking through seamless accounting and account reconciliation.

Why choose Neat?

Neat is a highly secured mobile currency account that you can fully trust, either you will use it for your business or for your personal use.

You can manage, operate, and send your money anywhere in the world.

Neat may be developed at Hong Kong, but you do not have to go to their office to acquire an account and a card. More so, there are no requirements needed for personal use. Receive payments and send money to your friends

Neat HK is a revolutionized and patented account opening process.

Get your mobile app at the Apple Store or Google Play!

Special Offer For GFA Readers

Neat has offered a special promotion for those who signup through our link and coupon code – 6 months of a free business Mastercard for your Neat account.

To get it – click the button below when signing up and use coupon code GFA6MONTHS

Apply For Neat Online

Need a HK Co + Neat Package?

If you haven’t yet incorporated - we have a solution for you! The Global From Asia HKVIP package combined with the Neat Current Account (technically a bank alternative) solution is your perfect combo for a streamlined company setup and online banking solution.

Get Our HKVIP + Neat Combo

Already have a HK company?

Many readers are setup with a HK company but struggling for HK bank options. You can apply for Neat here and they will see you came from GFA for special expedited support.

We hope you enjoyed this blog post, Neat is now in open beta (when we first wrote this it was i private beta) if you would like to apply- feel free to use our affiliate link here.

If you are our HK incorporation client, then we will help you as well.

Signup for Neat

User Reviews about Neat HK

We have had many people connect with us about the Neat online banking service, feel free to submit yours.

slow funds recovery

Terrible support, shouldn't be in fintech

Great experience so far

Good experience

Do not use neat beyond tier 3.

Seems not serious

A much needed HK business solution

Great Hong Kong Banking Solution

Hard to get information

Hard to get information

Run away from NEAT !

Don’t do it unless you have to

Works well & convenient

thank god I have this lol

CEO

CEO

Helps My Growing Startup

Great experience

Thanks to NEAT HK the Bank nightmare is over

Doesn't Support Stripe?

I'd Be Cautious

27 Comments on “Neat HK: A Solution for the Hong Kong Banking Nightmare? Reviewing Neat – Online HK Business Banking & Connect Your Paypal/Stripe”

I’d be cautious. They invited us for their ‘closed alpha’, got all kinds of sensitive information from us (from passport details to account numbers and financial documents), then disappeared for a month. When inquiring about what’s going on we got a message back that their ‘compliance department’ declined us. Wrinkle, they have no compliance department. And all communication, from social media to new accounts, to ‘compliance, all one person. Makes you go hmmm.

And the management team is all foreign, mostly Russian. I’d be careful.

Hi Jake, at Neat we take our compliance process very seriously. That is why in some cases it takes longer than a week for an account opening application to be verified. If I’m not mistaken your company account was indeed opened and I hope you are enjoying our service. As you can see from our website (https://www.neat.hk/about) we actually do have an experienced compliance officer in house. Additionally, our multi-cultural team is highly skilled with years of experience in large banks and technology companies. Feel free to check our LinkedIn profiles from the About page on our website. Best, David

Hi David, as of today something is happening and my funds are nowhere but in my account. I would appreciate if you could see with Payrnet where my funds are. I am unable to pay my employees!!!

I’ve contacted stripe and they replied saying they don’t support neat…

Hi Steve,

its a Standard Chartered bank – you don’t need to mention Neat – do you have a Neat account already or are considering one?

Hi Michael Michelini,

I am in a middle of a situation with NEAT.HK, and i’d like mention an important information about NEAT.

NEAT didn’t actually open any bank account at the Standard Chartered Bank, ONLY NEAT hold a bank account to the Standard Chartered Bank. All the NEAT Business account peoples will open with NEAT will be Virtual Account on the supervision of NEAT.

Furthermore, if for any reason, Standard Chartered Bank decides to close NEAT bank account, all the virtual account will be closed.

I just get this information after a big issue with NEAT, and i decided to contact Standard Chartered Bank which simply told me that they cannot do ANYTHING for me for this very reason.

The next move for me since i cannot solve my issue with NEAT.HK will be to go Hong Kong and fill a complain to H.K Police for fraud since they took 30% (yes 30%) of fees to decline my T/T from a European bank to my NEAT account.

Looks very interesting. I would like to give this a try!

Do you have an idea when to expect the Xero integration?

Pingback: Applying To Hong Kong Banks? Results After Visiting 20 in 2 days (As an American Entrepreneur)

Thanks to NEAT HK the Bank nightmare is over. Personal Bank account in 10 Minutes and Business Account in 2 days! I went the ;last 18 months to different Banks in HK….tons of paperwork, sent a lot of money for anything they asked…even they required 10k HKD as initial deposit i was willing to do but now i hope the Nightmare starts for them…they are useless now!

awesome – happy to hear this news and thanks for sharing on the Global From Asia blog – we will have a review section here very soon!

“Unique Account / IBAN number – you will have your own dedicated account number with Standard Chartered.” Is it really true? I checked their FAQ and the beneficiary for top up is epaylinks Technology Co., Limited (https://faq.neat.hk/en/support/solutions/articles/35000044224-how-can-i-top-up-my-neat-account-from-a-foreign-bank-account-) so do they really have individual IBANS? I work with satchelpay and i’m very happy but would try Neat as well if they actually have individual ibans.

For Business solution it is – consumer is what you are talking about ?

Pingback: The Story of Neat Hk Developing in Hong Kong to Help the Banking Market with David Rosa and Igor Wos

good experience with NEAT but NEAT Business its a bit weird. i applied my Card and they sent it to my german address …this is the address i chose when i opened the company in HK…my personal card they sent to my business address in HK but the business card to germany…when i asked them to send it to my HK address… they said need wait until the card is back from germany…6 weeks…still waiting!! 2nd…after 7working days still no funds in from germany which usually takes not longer than 2 working days….not sure after it solved with the funds i will still use it…not happy!

Hey,

I think 2 Mio per year wont be enought. Our annual revenue is around 5 mio. How can we handle this?

Interesting. Looking forward to try this one out, especially for a digital nomad like me!

Been using Neat for a year or so now, from the beta version. It’s useful to pay small bills, despite the high commission rate. Nevertheless every-time I receive money from clients, I had troubles. Every-time I send them the transfer slip from my client, and I have to contact the customer service to ask where the money is few times. And it’s always the same, they can’t locate it, they are looking for it, and finally they find it after a week. From Hong Kong to Hong Kong 7 days to be credited on my NEAT account. and then transferring money to pay salaries: transfer blocked, it’s under compliance review, need few working days to review….

Stay away, the business model is based on grabbing commissions from entrepreneurs, using the banking default system in HK to make profit.

Their customer service is apparently the worst. You money will always be at risk. I recently encountered with multiple issues.

1. Their account numbers are weird and confusing. I provided my wire info to my clients in US and 3-4 times payment bounced because as instructed by Neat you need add the branch code along with account number but not all banks accept that format.

2. One of the client missed out passing branch code information in account number but they added to the branch code section in their bank online form, but payment didn’t show for at least 15 days when i contacted Neat support they mentioned it will never reach since the client failed to add branch code along with the rest of account number and i was advised to ask my client to recall and resend by adding branch code along with account number, i repeatedly asked them to contact Standard Chartered bank and get a written confirmation that this payment has not arrived and will never arrive by their support team denied to even contact the bank. So i asked client to do so, and surprisingly the payment arrived in next 15 days and then Neat received recall request since they asked me to ask my client to do so. And Neat froze my money. Their compliance team asked for documents proving the payment, contracts and invoices and asked reason for this recall and asked me if i should accept or deny the request so i provided them with all the relevant documents and asked them to deny the request since there is no point sending payment back then asking again from my client. And i also informed my client to withdraw recall request which they did so.

Its been 25 days i have tried reaching their support multiple times to unfreeze my money since i already gave them all the proof they need in-fact i shared emails from my client accepting the fact they have already withdrawn the request of recall.

Their support team now asked me to get swift slip from my client, first all this is annoying my client since this all issue was caused by negligence of their support team. I strongly believe their support and compliance team never even shared my invoices to the bank and never conveyed my message to Standard Chartered to deny the request of recall. And apparently i was right, since i received this email from my client today:

“Feb 15, 14:51 PST

Harsh-

I have received a full update from our partner bank. The problem here is that your bank never responded to the original requests for a recall. Our partner bank reached the limit of their contacts and closed out the case. The only message that was sent out was the message to recall the funds. Because authorization was never given after several attempts, our partner bank closed this case.

I had to open a new case with them to find out where the funds are and for Wells Fargo to communicate with them. I will collect the Swift Messages as I get them and continue to work with our partner bank to get your funds to you. “

Till date Neat support or compliance team have not given any more update and its very much clear to me though they definitely don’t know what they are doing. And i missed out the fun part out of this, due to this issue Standard Chartered suspended my account so i can’t even receive any more funds in Neat business account until they don’t come up with the new solution to over come this.

I would stay away from them, I had the worst experience with banking with them ever. Bottom line, out of the blue, compliance team decided to close my account within 7 days, without explanations of any kind. Forcing me to empty my bank accounts, obviously with all sort of limitations… A complete nightmare and hoping people think twice before embarking the account opening with them.

Just don’t bother it’s a scam, I haven’t been able to use their services for the last ten month.

They just completly destroyed my business. Never put your trust in them.

They just get KOL on the internet to say good things about them.

“A solution from the Hong Kong banking nightmare ?” = Neat is a worst nightmare.

Neat gave me a HK account and a card, then closed it few months later.

Neat gave me a EURO UK account trough Payrnet/Railsbank, then my money disappeared.

The 1st SEPA transfer went well in 1-2 days.

Then I got 2 SEPA transfers of more than 1000€ that disappeared trough them.

I have proof of payement, a famous normal bank sent money to my Neat company account, it’s been 9 daus, and I still have no news of where is my money and what happens.

This is theft and they put me in danger by stealing my money like this.

I think NEAT might have problems with their current partner bank. I think their partner bank have stopped working

with them, because NEAT are integrating with new Hong Kong banks the next 2 months, and they say opening new business accounts

will take atleast 2+ months..

Keep away.

They are a total dud.

They make a lot of promises – keep none of them.

Paypal integration – forget it.

Suitable for business and start ups – forget it.

They lead you on with continuous proposed updates and services which never materialize.

What they have mastered is promotion and a staggering level of bureaucracy that would make governments envious.

No customer service to address problems and there are always problems.

I think I can say with accuracy they are plain dishonest and have actually zero concern for the welfare of their clients.

NEAT is a SCAM! Don’t do it!

Agree with Jake’s comments below – they ask you to send all kinds of sensitive personal information that is not necessary – bank accounts, passport details, employer and job role all for ripping off via their scam department.

Neat withholds your money and gives you pitiful excuses why they can’t credit your account. NEAT refuse to return your money and close your account. NEAT customer service is woeful, unhelpful and the response time ranges from slow to non-responsive. Time to report them for theft.

Pingback: Multi-Jurisdiction Multi-Currency Accounts: What They Are and How They Save You Time and Money

Pingback: Websites in China and Optimizing For Chinese Web Traffic with Jons Slemmer

Pingback: [Followup] Running a Chinese Import/Export Company Outside China with Rico Ngoma