Currenxie made the business community diminish the barriers between trades through their offered solutions of an efficient FX and cross-border payments.

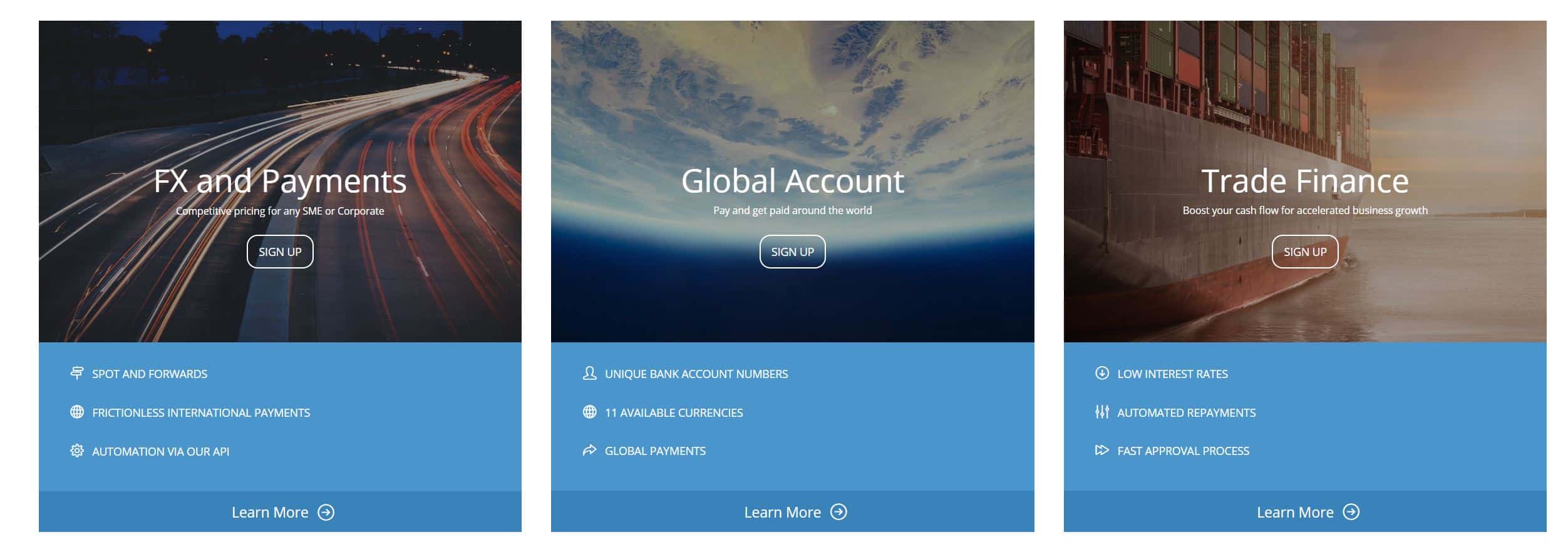

Currently, Currenxie has three available solutions to offer. These are FX and payments, global accounts, and the new one, trade finance.

FX and Payments:"Competitive pricing for any SME or Corporate"

This solution offers a real-time access to transact online to the wholesale FX markets without worrying the requirements for currency conversion. You do not have to worry with the risks in FX and payments because it protects the profit margin of your business through the restriction of FX volatility risk by locking in an FX rate up to a year in advance.

International payments? You do not need to worry! The global payment solution of Currenxie allows a secure and fast payment transactions in 18 currencies to over a hundred of countries.

Here are the following available currencies:

- Australian Dollar (AUD)

- Canadian Dollar (CAD)

- Confoederatio Helvetica Franc (CHF)

- Chinese Yuan Renminbi (CNH)

- Danish Krone (DKK)

- Euro (EUR)

- Great British Pounds (GBP)

- Hong Kong Dollar (HKD)

- Indonesian Rupiah (IDR)

- Japan Yen (JPY)

- Korean Won (KRW)

- Norwegian Krone (NOK)

- New Zealand Dollar (NZD)

- Swedish Krona (SEK)

- Singapore Dollar (SGD)

- Thai Baht (THB)

- United States Dollar (USD)

- South African Rand (ZAR)

Currenxie has built this solution in an innovative digital platform. It provides a simple yet fast transaction management from a single interface.

How does this solution work?

- Have a registration online and transact. Sign up or log in your account

- Send the money through an electronic transfer.

- Receive the funds on the beneficiary account.

Global Account: “Pay And Get Paid Around The World”

When you sign up with a global account, Currenxie offers a single interface with a global dashboard that allows you to view your balances. It holds 11 currencies and allows international transfers in 18 currencies. What are these currencies?

- Euro (EUR)

- United States Dollar (USD)

- Great British Pounds (GBP)

- Japan Yen (JPY)

- Confoederatio Helvetica Franc (CHF)

- Indonesian Rupiah (IDR)

- Hong Kong Dollar (HKD)

- New Zealand Dollar (NZD)

- Singapore Dollar (SGD)

- Canadian Dollar (CAD)

- Australian Dollar (AUD)

Let us diminish the barriers, this seamless cross-border payments with transparent mid-price FX rates.

You will get paid with the following marketplaces:>

In a span of 24 hours, Currenxie will approve the sent application and will issue a unique bank account number.

Trade Finance: “Boost your cash flow for accelerated business growth”

Access trades with Currenxie at a low interest rates, this finance solution will surely suit for your business. Low interest rates is not just the advantage, this finance solution also offers inventory, logistics, or receivable financing. Your specific needs are in good hands with customized solutions

An automated repayment is assured through the deduction from the incoming payments from the marketplace. More so, it only takes 24 hours to review the financing applications.

Trade finance of Currenxie supports the following marketplaces:

Do not worry, there are still marketplaces who are about to join!

How does Trade Finance solution work?

- Be an active eSeller collections client.

- Provide marketplace sales data through API.

- Enable the financing facility.>

Recap: Why Currenxie?

Currenxie is legitimate and 100% trusted. It is licensed as a Money Service Operator regulated by the Hong Kong Customs and Excise Department. The security and safety of your money is the sole essential of Currenxie. There is only no to little transactional risk for Currenxie, because they only offer currency exchange through the P2P platform or interbank market.

All money transfers are secured with two factor authentication, and emails are sent after each money transfer

Check Another Alternative

At the moment, we no longer have communication with Currenxie – they have cancelled our collaboration and there has been a huge turnover in staff at their company – they cancelled the accelerated review and cancelled our commissions. Very disappointed and sad they would do this to GFA as well as our users.

One Comment on “Currenxie: Competitive Digital Finance”

Currenxie is a great tool for handling digital finances, especially that it has been regulated by the Hong Kong Customs and of course, the Excise Department. Thank you for this informative blog post!