What is the most important part of opening a new company – in Hong Kong or anywhere?

Getting a bank account opened up.

Having trouble getting a business bank account open in Hong Kong? Or other parts of the world?

You’re not alone.

I’m hearing it more and more from everyone. More and more rejection letters.

Have you been following international business trends over the years? Then you have seen quite a tightening up on new business account openings. Hong Kong is a financial center of the world, yet the past couple years has been getting so much more of a hassle to get an account opened.

As I have been working with so many clients with their bank account opening headaches. This sparked my interest to re-experience this tedious process for myself.

It is much more difficult than “back in the day”!

I spent 2 days visiting as many banks in Hong Kong as I could. There are so many banks in Hong Kong! I estimate there to be over 50, depending on your criteria for a bank – commercial or retail or investment. I was able to cover about 20 of them. That is – depending if you consider walking into a branch and getting an immediate rejection as a bank visit or not!

How Is Your HK Bank Search Going?

Before we get too far into it, let’s share where we are in the Hong Kong banking process, fill out the quick poll below and see where others are in your situation too.

Alternative: Cross-Border Payments

As banking in Hong Kong is near impossible for non-HKID holders, we have started to see more and more business owners leveraging cross border payments, check out our full guide and comparison.

Download The Checklist

A reader, Ben, sent me this amazing email and I want to share it with all of you:

Hi Michael,We spoke online a while back regarding a HK bank account, we also met at the DC BKK conference where we spoke about the requirements and struggles of a HK bank account.

The last time I went to HK I came into a few difficulties this time I’m going with a rental month contract for my Bangkok residency (don’t laugh!!), and will explain I’m growing the business in Asia etc and don’t have utility bills etc.

I guess my chances are pretty slim, so I decided to hit a few banks while I’m there. This lead me to creating a spreadsheet with lots of useful info which I think I would be useful for your listeners / site visitors. I used your post as a base and then worked through.

It includes which banks / phone numbers / branches etc. So if anyone is in a similar situation to me (with slim chances) then they can organise multiple interviews as I have.

PS

Do you have any tips as to how to handle the interview at the bank? From our last conversation I understood I have to say I’m starting operations in HK / Asia, plan to grow the business there, hence the bank account…Ben

To get this bank appointment checklist, please Click Me!

Now, back to the normal banker guide!

Update from a Reader Nov 2017

Still tough, even tougher, to get a Hong Kong bank. A reader, let’s say “Joe” sent in this report:

we are going round with banks. some feedback as below:dah sing bank: no to passport applicant

ocbc wing hang: we dont accept e-commerce trader

bea: we cant accept TT payment that dont have full details of transaction (reason local bank compliance regulation)

DBS: on going review, no idea of account opening yet, seems that it will be costly if they willing to open

HSBC: closing our current account, been banking with them since 2009. comp secretary told us to retry opening an account again. (we called and asked for reason they didnt want to tell, asked to write : closure team for the reason)

standard charted: no respond yet

boc: need a physical office

citibank: need a physical office

UOB: need HKD1million and said they dont actually serve SME

Wing lung: no respond at all

Hang Seng: emailed documents, have yet to hear backlet us know if you have any luck with the bank. it seems that you walk in to the bank? i have been told banks in HK dont entertain walk in.a distressed reader

And he got back to us towards the end of November with this to share:

good day!thought some updates for your readers.

last we spoke we met up with DBS and was told would take 3-4 weeks as long list of application.

banker said HSBC and standard charted closes a lot of accounts of late. so hence the long waiting time to pass the approval, DBS set up fees is steep HKD10000.

and i believe monthly account fees is HKD150 for online banking.on another note, met with a RM in OCBC wing hang branch in central, tried to sell me some insurance products and said will ease my business account opening but still subjected to approval. Same info i got with Public Bank HK, wanted to discuss some products with me. Wonder if you have feedback on this? it is really easier to open a business account with them if we buy their insurance products? We didn’t continue the account opening process with ocbc but was just wondering perhaps some info would be helpful to your readers who looking to open a business account in HK.

other banks that were previously said will get back to me didnt get back to me for eg. hang seng bank. Maybe because they are linked with HSBC.

i managed to open offshore business account in singapore for my HK company as well but i dont really like offshore account as i strongly believe a biz registered in HK should have a local bank account.

once i have settled my banking and get more feedback with the banks, i will probably email the team in InvestHK and HKMA about this hassle and trouble. HK dont seems like a good place for business anymore, cost has definately gone up a lot since we incorporated in 2009.

distressed HK business owner

Let’s hope it gets better….some new services forming I hope to announce soon.

Another Nov 2017 Update

Another update towards the end of 2017

Hi Michael, thanks for the very informative blog post – lots of interesting information and I just wish I’d seen all of this earlier!

I’m actually coming to Hong Kong on Monday (the first visit in years) and had expected to attend a bank account opening appointment with HSBC in Wan Chai. However, having submitted all the requested documents, they aren’t even willing to meet with me and have denied the meeting request! I registered a HK Ltd company with Startupr.hk some months ago and was aware that the setting up of a HK business bank account could be difficult – but thought that if I visited HK in person, with the correct documentation i’d manage to get one somewhere – now I’m not so sure… To give you some background – I’m from the U.K. so a British Passport holder but I am based in Indonesia, so no HK address other than a leasing agreement for a virtual office with Jumpstart.hk

My question is this: Since I am coming to HK anyway between Monday and Wednesday next week (partly for an Indonesian visa run and also to process another visa for China to meet a potential business partner in Shanghai on Wednesday night) do you think it would still be worth my while collecting my official company documents from Startupr.hk and visiting any branches in person? Also, it sounds like you have a ton of experience in terms of doing business in Asia and I’d love the opportunity to meet for a quick coffee if you have time? There may be the chance to collaborate in some way?

PS If the traditional bank account fails I’ve found a new option with Neat Business.hk – so there is a chance that all is not lost yet…Richard

Now back to the original article.

What I told the Bank When I Visited

I’m sure depending on the day and the client services rep I talked to at the bank I would get different results. For this exercise, here is what I disclosed to the bank tellers and client account managers when I walked in:

I did this to represent most of the clients I am working with. Though the American nationality was an extra negative in this process. We’ll will dig going through these various banks below.

What have your own experiences been in applying for bank accounts in Hong Kong? Please note, this is for business (corporate) accounts, and not personal. I believe personal accounts are still easy and straightforward for you to get in HK, but didn’t attempt that in today’s post.

Now, in no particular order, let’s dig into each of the banks I went to:

Updates September 2016

We are still getting tons of emails from readers, such as the below:

Curious if it’s still possible to get a bank account for HK company. We’ve been looking to do this for a while but keep getting jerked around. Recently we were about to head out a couple weeks ago to file applications, but we were told we needed approval from Mainland China to do so. So we didn’t end up going. What do you believe is feasible these days? We’re an e-commerce business and source/ship apparel products from Thailand. But because banking system isn’t great out here we need an entity outside of TH to link up with stripe, Braintree and such. Also I’m curious if it’s possible to sidestep the process by purchasing an existing HK company with bank account and transfer it into our names. Curious to hear from you what is possible these days.Cheers, Jordan

We have been discussing and updating people in our newsletter (such as this one about HKMA urging banks to loosen up) that the HK government and regulators don’t want the banks to be so strict.

But the banks don’t want to open up. Some say it is because they prefer dealing with only bigger clients anyway and use this as an excuse, while others say it really is because they want to be extra careful to avoid fines from US regulators.

HSBC

HSBC SME centers are all over Hong Kong. I went with my friend Mike “The Greek” as he doesn’t currently have an HSBC account. We went to the Jordan branch on Nathan road without an appointment.

Entering the retail bank location on the ground floor, the greeter asked how to help us. She was friendly and when we said a business account, sent us to the SME center on the 18th floor.

The secretary greeted us and then had a small business banking client rep meet us in a conference room within about 5 minutes. He asked us to confirm it was a business account for a Hong Kong limited company. He also asked if it was for a new company or a company that was older than one year.

He then gave us a checklist, which I’ll type out here:

Account Opening in Hong Kong – Limited Company Established in Hong Kong

* True copy Certification of Incorporation

* CPA / lawyer / banker / notary public in a Financial Action Task Force (FATC) member comparable jurisdiction acceptable to HSBC or

* Hong Kong Institute of Chartered Secretaries (HKICS) member, or

* HSBC branch officer

Recommended format: Certified must sign and date the copy document (printing his/her name clearly in capitals underneath) and clearly indicate his/her position on it. Certifier must state that it is a true copy of the original (or words to similar effect) and the number of pages to be recorded

Number of directors needed to form a quorum / beneficial owners to be present for the account opening.

* For the sample of the required documents please refer to the website www.commercial.hsbc.com.hk/1/2/sampledoc_e

A. Company Registration Documents

1. Certificate of Incorporation (CI) and change of name (if applicable)

2. Valid Business Registration Certificate (BRC)

3. Memorandum and Articles of Association (M&A) / Articles of association and any amending resolutions.

4. Latest notification of change of secretary and director (appointment/cessation) (form D2A/ND2A), return of allotments (form SC1/NSC1) and/or Instrument of Transfer, if applicable.

5. (For newly established company)

5a) Company Search report / company particulars search issued within 6 months and

5b) Incorporation form (NC1 /NNC1) or (NC1G/NNC1G) / Notification of First Secretary and Director (form D1) and

5c) Director / Shareholder / Beneficial owner declaration (DD),sample available upon request, issued within 6 months.

6) For company established over 1 year

6a) Company search report / company particulars search issued within 6 months and

6b) Latest Annual Return (form AR1/NAR1)

B. Documents Required from 2 Directors, All Authorized Signatories, All beneficial owners, and 2 key Controllers

– Identification document and nationality proof

C. Documents Required from 2 Directors, All Authorized Signatories, All beneficial owners, and 2 key Controllers

C1: Residential Address proof

C2: Permanent Address proof (if different from residential address)

D. Documents Required from 2 Directors, All Authorized Signatories, All beneficial owners, All key Controllers, and ALL direct appointees

D1: Full name, ID type, number, and date of birth.

E. Foreign Account Tax Compliance Act (FATCA) Documents

Applicable HSBC declaration form and/or IRS W form to establish your tax status under FATCA. For document templates and more information about FATCA, please refer to the HSBC website at www.faca.hsbc.com/en/emb/hongkong or IRS website at www.irs.gov/FATCA

F. Payments and Forms for Account Opening

F1. HKD check of 10,000 HKD for initial deposit, company search, and special company account opening charges, where applicable. (Please refer to the latest commercial tariff – http://www.commercial.hsbc.com.hk/1/2/commercial)

F2. Mandate, account opening form, and signature cards

G. Additional Documents Required for Special Companies

G1. Corporate Shareholders

Ownership structure chart showing company name, % shareholding, the country of incorporation, the country of business address in each Intermediate Owner up to the Beneficial Owners of the company and specifying the issuance of bearer shares in the chain of ownership (including the company, all Intermediate Owners and Beneficial Owners), certified by director. Indicate if there are family members amount the Beneficial Owners and the family’s total collective % shareholding, if applicable.

G2. If Beneficial Owners in your Company is a Trust

Trust deed, identification proof and residential address proof, and identification proof of trustee.

HSBC Bank Charges

Minimum balance is 50,000 HKD, else a 100 HKD/mo service charge.

The process was so fast it amazed me. The SME center was empty. We went at 10:30am on a Thursday so maybe that was a good time to go. Maybe I should come to this branch more often, the TST and Central branches are so overloaded whenever I visit there.

Leave your review and experience dealing with HSBC HK in our GFAVIP membership

DBS Bank

I went to three different locations for this bank. It was a rainy day in Central (i.e. typhoon) and I stepped into 1 DBS branch. They were nice to service me right away. I said business bank account, and they immediately told me they only helped with retail clients. Pointing me down the road to the DBS headquarters in “The Center” (A massive business complex) I proceeded to walk down Des Vouex Road. Not able to find it after asking a few guards, I figured I would find another branch later.

The next day on Kowloon side I went to one down the road from my friend’s apartment. They were also nice and told me to go to one at Mira Mall on Nathan road, on the 11th floor, for business banking. I didn’t have time to get there this visit. I’ll update this post with news from that branch.

The client services rep at the front office also gave me the number 2290 8345 to make an SME (small to medium sized enterprise) banking application appointment.

Update: So I went back with a client at the end of Oct, 2015. At their SME center at Miramall in Kowloon. After waiting in the customer service room for about 20 minutes, they spoke to us.

They said the account opening fee is $10,000 HKD (about $1,250 USD) and then the yearly fee to keep the account open is another $10,000 HKD (same as account opening fee). Totally crazy. My client wasn’t willing to pay (I understand completely) and we left.

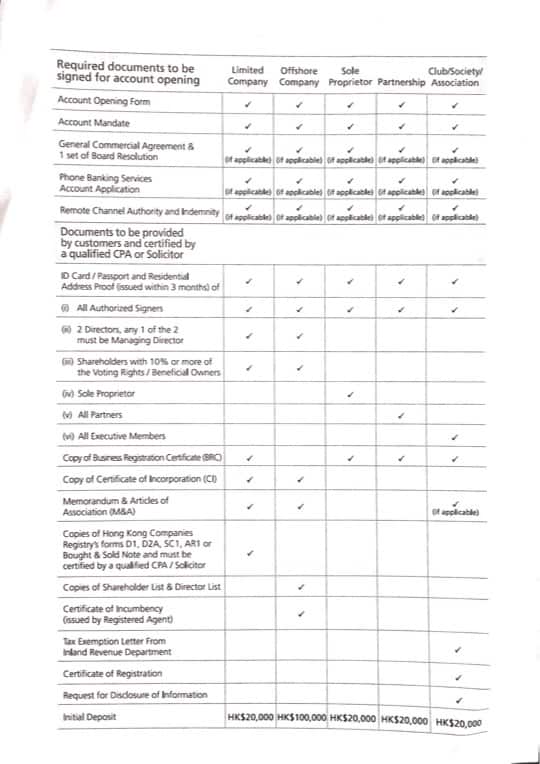

Here is the account requirement form we snagged before leaving:

Leave your review and experience dealing with DBS HK in our GFAVIP membership.

Chong Hing Bank

This was a bank I had not yet heard about until doing this exploration. I found their Jordan branch (again thanks to Mike the Greek for pointing it out to me!) and walked in.

Such a small bank, and there was two tellers and a line of about five people. I walked to the back and there were a few bankers on the phone. They seemed to be discussing the stock market with clients.

After one hung up, I mentioned that I am interested to open a business bank account. Being the only foreigner they may have seen in a while at the bank, he was wondering why I am interested in their bank?

I explained I want to have a few bank accounts in my company here in Hong Kong, so that if I had a client who wanted to pay me in one bank account or the other, they could choose to do so. Seriously, what is wrong with applying for bank accounts at multiple banks? I did explain I already have an HSBC bank account, thinking that would be a good thing. Not sure if it was or not.

He asked me more questions about my company. Where my clients have their headquarters? What is my company operation’s base. He checked my passport and looked for my visa. He saw that I am a visitor in Hong Kong, and I explained that I am under my Chinese company’s work permit in Shenzhen.

Seemed to cause more confusion. He was polite though, and then asked for me to wait while he asked his manager.

I sat. Such a different look and feel from HSBC. They were not catering to the foreign market here. Everything in Chinese language. Computers at the waiting lobby with stock trading platforms ready for clients to login and trade on.

When he came back, I could tell it wasn’t going to be positive. After at least 10 minutes discussing with his manager in the back room, he explained I need a HK ID card. I told him I already have an HSBC HK business bank account and that wasn’t needed. But then he explained I got that years ago and times are much more difficult now.

Guy was nice though. He gave me his business card and said if I get a HKID then it would be much more helpful for him to assist in opening a business account at Chong Hing Bank.

Leave your review and experience dealing with Chong Hing here in our GFAVIP membership.

Bank of China (Hong Kong)

Down in Central I walked into one of the many Bank of China branches. It is worth noting that I do have a bank account with Bank of China – but it is in Mainland China – not in Hong Kong. This is a completely separate entity and there is no connection between client accounts.

So I walked into the bank and pulled a number from the waiting machine. Just a few ahead of me, I saw with a nice woman who asked how she could help me at the bank today. I explained I have a business in Hong Kong and want to open a business bank account. She asked if it was for a limited or unlimited account. I explained it was a limited company. She was going to seat me down with a client service rep but I explained I wasn’t ready to apply today. I was collecting what information I needed to bring.

She walked to the back of the bank and got me a sheet of paper with a long checklist. I’ll type it out below to help you out. Seems like most of the other banks.

It also had a brochure of the account details and terms. Most interesting to you is that you need to hold 50,000 HKD to avoid monthly fee of 120 HKD.

I thanked her for her time and said I would come back to apply later. She gave me the customer hotline – 3988 2288 to call ahead and arrange an account opening interview.

Documents Required for Account Opening Bank of China (Hong Kong) – Limited Company Incorporated in Hong Kong

After making an appointment, please bring the following documents to the designated branch of Bank of China (Hong Kong) Limited (the “bank”) to open an account.

A. Company Registration Documents

– Certification of Incorporation (CI) and subsequent Certificate of change of name, if any.

– Valid Business Registration Certificate (BRC)

– Memorandum and Articles of Association (including all up-to-date amendments)

– Forms of Hong Kong Companies Registry

– Certified form D2B (if applicable)

– Certified form D2A (if applicable)

– Certified form D4 (if applicable)

– Certified form AR1 (if applicable)

Business address proof (if different from the registered office address

– Applicable to the “company by Guarantee Company”) Director’s certificate

B. Documents of at least two directors (the sole director of the company only has 1 director), principal shareholders (those who can exercise control the exercise of 10% of the voting rights of the company or its parent company) and all authorized signatories

– Identification document

– Proof of the former / other names (if any)

– Proof of nationality (if a person is not holding a Hong Kong permanent identity card)

– Current residential address proof (e.g. Documents with name and address issued by government authorities within 3 months. Utility bill bill issued within 3 months or statement issued by financial institutions within 3 months

C. Documents of company’s corporate directors / corporate shareholders (if applicable)

– Corporate director

Its Board resolution appointing a representative or representative to act for the corporate director and present at the bank for account opening

Its company registration documents (please refer to A above)

– Corporate principal shareholders

Its principal shareholders / beneficial owners (the private individuals must present at the bank for account opening and provide the documents listed in part B)

Note: Apart from documents listed above, we may further request you to provide other information and documents required for account opening, if necessary.

Leave your review and experience dealing with Bank of China HK in our member’s forum.

Bank of Bangkok

This one was going to be fun! Seeing a Thailand bank in Hong Kong intrigued me and I have walked by this branch many times during my years commuting around Hong Kong. Today was “all you can eat buffet” of banking visits, so I walked inside.

An exotic and expensive interior. Felt like a temple, with high ceilings and brass metal trimmings and a green hue. I walked to a teller and explained I was looking to open a business account for my Hong Kong company. She said that it needs a referral, but I can wait for the manager to discuss.

She pointed me to a corner desk in the front right of the bank and I walked over. The manager was a professional woman, and was dealing with a client. My Cantonese language skill isn’t so good, but they were having quite a nice conversation. I wondered if she was a big client for the bank, trying to determine how bankers may decide who to treat well and who to pass by.

After about 10 minutes their conversation was over and she invited me to sit at the desk. I explained I’m a new business in Hong Kong and want to open a bank account. She said:

“You need a referral.”

So that was it, I said is there any other way. She said no, need a referral. She was polite about it, but I was still amazed they would turn me down down flat out without any questions about me and my business.

So that was 15 minutes or so of a waste. Time to head to the next bank.

Leave your review and experience dealing with Bangkok Bank in our private forum.

Public Bank Hong Kong

Next door to Bank of Bangkok is a bank called “Public Bank Hong Kong” (pretty generic right?). Walking in, there was a client services rep available at the desk to the right and he asked how he could help.

I explained I’m looking to open a business account for my Hong Kong company.

He said interjected:

Need a referral.

I said no other way, he said, no. He apologized and wished me well. That was a quick one!

Leave your review and experience dealing with Public Bank with other members in private.

ICBC

Walking into ICBC I went to the second floor of their branch to the business department – this was in TST, Kowloon district. Waiting at the teller line they pointed me to a desk for client services.

It was a nice woman who greeted me and invited me to sit down right away. I explained I wanted to open a business bank account.

She asked if I knew anyone in the bank who had an account.

I needed a referral. But she worded it as knowing someone else who had an bank account there and if they introduced me to the bank.

For the sake of this blog post and assuming I am a foreigner visiting Hong Kong to do business for the first time I said, no I didn’t have anyone I knew there who had an ICBC bank account. She apologized and said I needed to know someone who had a bank account there for at least 1 year (I believe it was 1 year).

Knowing I wouldn’t be able to find another way, I asked her if I could at least get a brochure of the banking account options or other checklists. She said they didn’t have that and to check the website.

Thanking me for my time, she said goodbye. I walked downstairs.

Going to the MTR I saw massive billboards advertising ICBC. I wondered, as a marketer myself, what the cost was for that and then to turn away potential clients right off the bat when they walk in the door.

Leave your review and experience dealing with ICBC talking in our membership series.

China Construction Bank (CCB)

Here is another bank that is more seen inside Mainland China, and they have a separate banking entity here in Hong Kong. I walked in to one of the many I saw and asked about a business account. The first time I went in they gave me a phone number to call, but during my day I passed so many I walked into another.

This branch was pretty friendly and brought out a piece of paper with a list of all their branches. The teller then highlighted 3 of the banking branches where you could apply for, and get client service for, your business bank account.

Here are the 3 locations to apply for the business bank account. I’ll have to stop by one of them and update this post.

Wanchai Hennessy Road

Unit C, 20th floor, China Overseas building, 139 Hennessy Road

Wan Chai, Hong Kong

3918 6708

Kowloon Bay CCB Centre

SME Center

Ground Floor,

Kwun Tong, Hong Kong

3718 3422

Sheung Shui

SME Center

Units 1103A-06, 11th floor, Landmark North

39 Lung Sum Avenue

3918 6722

Sheung Shui, New Territories

Leave your review and experience dealing with China Construction Bank in a private forum.

Citibank

At first I wasn’t even going to bother going into Citibank. I have just heard because they are a USA bank they won’t help Americans open bank accounts in Hong Kong anymore and tell you to apply to Citibank USA.

But what the heck, let’s swing on in.

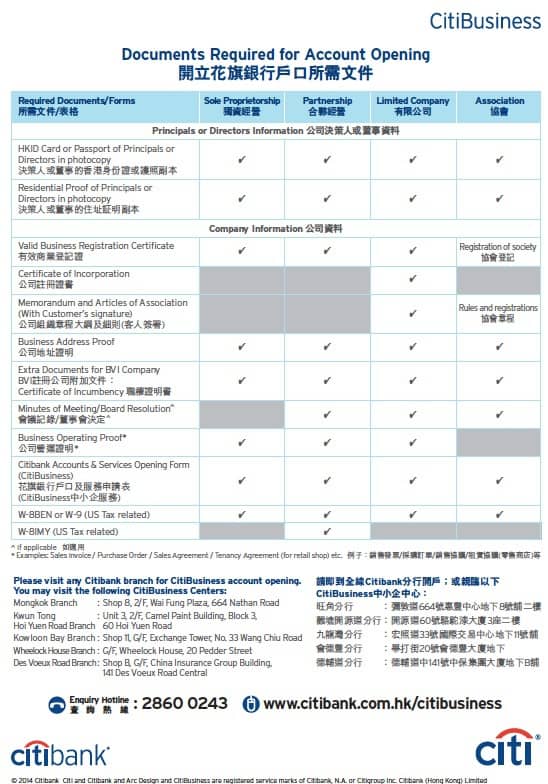

A nice guard greeted me at the Jordan branch on Nathan Road. He pointed me to the small business division of the bank and there were 3 tellers all ready to talk and available. I picked one. She was nice and immediately pulled out a checklist of what I needed to provide. To get a business bank account with them, as I typed out below:

Principal or Directors Information

HKID or Passport of directors

Residential proof of Principals

Company Information:

Valid Business Registration Certificate (BRC)

Certificate of Incorporation (CI)

Memorandum And Articles of Association (with customer’s signature)

Business address proof

Extra documents for BVI company (certificate of incumbency)

Mines of Meeting / Board Resolution

Business Operating proof – examples – sales invoice, purchase order, sales agreement, tenancy agreement (for retail shop), etc.

Citibank Accounts & Services Opening Form (CitiBusiness)

If American – W-8BEN or W-9 (US tax related)

I also explained I am American and if it was a problem. She didn’t seem to make me feel like it would be a problem, and just pointed to the bottom of the checklist for the American requirement part.

The whole ordeal took just ten minutes or less. But again, who knows how hard it would be to get accepted after applying. Yet it was still nice to know I could just apply, and not deal with this long inquisition about who I am, or require me to “know people”.

Update, November 2015 A reader, Doug, shared his email correspondence from Citibank:

I contacted Citi through their online form, this is the response I got back.

—

Dear Mr Doug,

Thank you for your interest in account opening in Hong Kong.

Attached please find the basic document requirement for account opening and the five Citibank Citibusiness branches address.

Kindly bring all the original copies when visiting our branch cause there is no pre-approval arrangement before arrival.

Please note that both the Director and the Shareholder (over 10%)/Authorize Signer need to be in person in Hong Kong for account opening.

For your information, company should be registered in Hong Kong and with an operating office in Hong Kong.

Please be reminded that all account opening will be subject to the final approval of the bank.

Once again, thank you for choosing Citibank.

Leave your review and experience dealing with Citibank and get more insights from private members.

Chiyu Bank

This was another small bank I had noticed in the past walking around the city but never paid attention. It has a pinkish / purple banner logo that now will forever be in my memory.

Walking into a branch on (or near) Temple Street, the guard opened the door for me with a smile. He directed me to a row of desks for new account applications. I may have been one of the first foreigners to enter the bank for quite some time, they were all a bit shy to service me. Finally a woman bank teller invited me to sit at her desk.

She asked me how she could help. I explained I opened a new business and needed a bank account. She asked me a few more questions, one of which was my nationality.

I answered I was an American.

After collecting the information, she then went to speak to her manager about it.

A few minutes later she sat back down and apologized. The bank cannot accept new bank account applications from US Citizens. She explained there is a lot of paperwork and regulations for Americans now and they are not able to help.

I thanked her for her time and the guard opened the door for me as I left the bank. Again, with a smile.

I guess now I know how it is to be discriminated against. Flat out told you can’t do something based on your nationality.

Next bank…

Leave your review and experience dealing with Chiyu Bank talking to others who have been through it, in privacy.

Dah Sing Bank

This is a local bank whose logo has stuck out to me over the years. I walked in to a branch across the street from my Nathan Road office address in Kowloon. It was a small corner unit branch with 2 floors. The teller on the first floor told me I needed to go upstairs for the business banking.

There were only tellers on the 2nd floor, behind glass. I waited my turn in the queue and went to my assigned teller. She was shy to speak English to me and blushed a bit. She leaned over to the teller next to her and they switched his customer with me. A quick flip of the customers and I talked to the male teller now.

He asked me a range of questions, who I am, where is my business registered, what is my ID, do I have a HKID. After a bit, he went to the back to get me more information.

After coming back, he then explained I needed a 3 year old client referral. That means, a client who has had a current account with them for three consecutive years. Maybe I can find someone I explained. I asked for his name card, but he didn’t have one and gave me the VP of the branch’s instead.

I complimented his English skills and left the branch.

Leave your review and experience dealing with Dah Sing Bank connecting with high level entrepreneurs in private membership area.

OCBC Wing Hang Bank

Down the street on Nanthan Road I saw OCBC Wing Hang Bank. They have a bright red logo that has always caught my eye. Time to step in and see what is up.

Waiting for the tellers in the back, I was up next. The teller made a call to the account rep in the front and Kelly came to get me.

I sat at her desk. She asked if I had any other banks, I explained I do have HSBC. She then wondered why I would want any other banks in HK. I explained I wanted to have a few options for different customers.

She pulled out the form and marketing brochure, and here is the summary.

Need 50,000 HKD minimum to avoid bank fees

Else 80 hkd/mo

Checklist:

Business Registration Certificate (BRC)

Certificate of Incorporation (CI)

Proof of residential address of all directors and shareholders with more than 10% holding, 3 months

Signature of bank signers

Completed Account form

Certified copy of resolutions

Memorandum and Articles of Association

Seems I could have applied right then and there, but I said I would need to gather all the information and come back.

Leave your review and experience dealing with OCBC Wing Hang Bank behind closed online doors.

Wing Lung Bank (China Merchant Bank Member)

In Central I swung up to Wing Lung Bank. This merged with China Merchants Bank (CMB) a few years back as I remember. Before it didn’t have the CMB logo. Out of nowhere throughout the branch network I saw the logo updated – so the recent merger is my own assumption.

It was a massive branch, with escalators taking all visitors to the second floor. I waited at the teller line and then they directed me to the client services department.

I saw 2 available agents and asked if they could help me. One volunteered and asked me to sit down.

He was a nice guy and gave me the checklist and bank account brochure. Here is the information he provided:

Documents below for the purpose of account opening should be certified true copies by Directors / CPA / Solicitors

1. Copy of Certificate of Incorporation (CI)

2. Copy of Business Registration Certificate (BRC)

3. Copy of Memorandum & Articles of Incorporation (M&A) and any amending resolutions

4.

A- (For newly established companies)

– Copy of Notification of First secretary and director (form D1) / Incorporation form (company Limited by Shared) (form NC1)

– Return of Allotments (form SC1) and/or Instrument of transfer (if any)

B- (for company established over 1 year)

– Copy of Latest Annual Return (form AR1)

– Copy of Notification of Change of Secretary and director (Appointment / Cessation) (form D2A) / Return of allotments (form SC1) and/or instrument of Transfer (if any)

5. For directors / Authorized signatories / Shareholders with 10% or more shares (but not corporate shareholders), please provide the following documents

– Identification document

– Residential information (within 3 months)

6. For directors / authorized signatories or shareholders which are local / BVI corporate entities, please consult our staff for documents required

Here is the big news! So I said I am interested to apply soon. I was expecting that to be good news, but he said there is a backlog. It would take 3 months before the bank could review my account application. He explained that once I apply, it would be set in a waiting line now and that the backlog was at least three months.

Jeez, three months! I guess if this is just a secondary bank account or I have no other choice I would go ahead and apply. Unbelievable.

He gave me his name card and said he could help me if I had any questions.

Leave your review and experience dealing with Wing Lung Bank in the GFAVIP program.

Fubon Bank

A few friends recommended I try this bank out. Walking in to the branch in Sheung Wan, I wanted to see what the fuss was about. I couldn’t find an area for business banking, so approached the investment division. A professional man invited me to sit down and discuss my situation. I explained I wanted a business bank account. Again, asked me about my company, is it a local HK company, is it a limited company, and other things.

He wasn’t a business banker, but he had a good grasp of what was up. I’m not sure if I could have applied on the spot, but I told him that I was gathering information today and would come back. He went to the back to get me the checklist and brochure. Here are the highlights:

5000 HKD min, else 50 HKD/mo fee

ATM card depends how many signers on the bank, need a 50HKD annual fee

Need introduction.

Online banking – yes

Memorandum of Association and Articles of Association (and any amendment resolutions). As company incorporated on or after March 3, 2014, only Articles of Association (and any amendment resolutions) is required.

Copy of Certificate of Incorporation and Certificate of Name Change (if applicable)

Copy of Business Registration certificate

Copy of Incorporation form (Form NNC1 or NNC1G) (or last annual return (form NAR1)) plus all subsequent Note of Change of Company Secretary and Director (form ND2A or ND2B), Return of allotments (Form NSC1), Instrument of transfer detailing the particulars of the current directors and principal shareholders.

Company search (as an alternative to document item 4 above)

Copy of Hong Kong ID card or exit-entry permit for traveling to and from Hong Kong and Macau. Or passports of a minimum of 2 directors, including the managing director (unless company has one directory only, or more than 2 directors are required to form a quorum), all authorized signatories, all principal shareholders, and all Ultimate Beneficial Owners.

Residential address proof. Such as bank statements and utility bills (issued within the last 3 months)

Details of ownership structure and control of the company, e.g. An ownership chart.

If directors or shareholders are corporate entities, document 1 to 5 should also be provided for these companies.

If directors are corporate entities, copy of directors’ board resolution of corporate directors resolving to appoint authorized representatives to handle banking business of other companies.

Global Application for Accounts and services- for corporate / entity and self certification on U.S. Person.

Important Note:

Copies of all documents submitted should be true copies certified by suitable certifier. If original documents are not in English or Chinese language, an English translation of the same should be provided.

Apart from documents listed above, we may further request you to provide more account opening details and documents when necessary.

The bank reserves the right to decline any account opening request without providing any reason.

Remarks:

A copy of passport must be provided if the individual does not hold a permanent Hong Kong ID card. (I.e. A letter “A” will be shown on a Permanent Hong Kong ID Identity card)

A copy of deep poll must be provided if the individual has changed his/her name in Hong Kong Identity Card (I.e. A letter “N” will be shown on a Hong Kong Identity card).

If the individual is Taiwanese person, copy of National Identification Card of the Repblic of China should be provided.

Suitable certifier definition:

– A solider, an accountant, a notary public, an auditor, a tax advisor, or a member of the judiciary in an equivalent jurisdiction.

– An officer of a regulated financial institution incorporated in, or operating from, and equivalent jurisdiction

– A member of the Hong Kong Institute of Chartered Secretaries (HKICS)

– An officer of Fubon Bank.

– An officer of an embassy, consulate, or high commission of the country of issues documentary verification of identity

– A Justice of the Peace

Instead of providing copies of documents certified true by suitable certifier, you can also present the original documents to any of our branches for certification by a bank officer.

In the event of any inconsistency between the English and Chinese versions of this document, the English version shall prevail.

Update: October 2015. I went back to this bank with another client. They saw that the company was just opened a week ago and didn’t like that.

They took copies of all the documents we had and said they will call us. They seem to want to meet in person a few times before opening the account.

Leave your review and experience dealing with Fubon Bank here in a private space.

Shanghai Commercial Bank

Another local bank I walked past a ton of times in Kowloon and never paid attention to. Entering the branch, the guard was super nice with the door and a big smile. On the left there was a corner area for clients to do stock trading. About six terminals with stock tickers passing, it was a full house. Chatting and socializing, while also trading stocks and reading the newspaper. Seemed like a mix between a coffee shop and a casino.

Anyway.

I walked to a desk on the right, and he was in the investment division. The man was nice and brought me to a desk in the back left side of the branch and asked me to wait. Another client service rep walked in from the back office. He asked me a few questions about my business and why I was picking his bank.

I explained a friend recommended the bank to me. He wanted to know who, and I gave him the company name and person’s name. That seemed to help out a lot. He was much nicer to me it seems after he came from checking out the company that introduced me.

Most likely I could have applied right then and there, so I had to explain I wasn’t ready to apply now and wanted more information. He gave me a brochure. For the checklist he wrote on a sticky note:

CI

BRC

M&A

Here is the account info:

I felt pretty good about this bank, and will apply for it once I get all my information ready.

Update: October 2015. Went here with a client. They really kept asking if the account holder would do business locally in Hong Kong. They said they focus on local businesses, not overseas companies.

He took all the documents and will email us.

Leave your review and experience dealing with Shanghai Commercial Bank talking to others who have done it.

NCB Bank

This bank is a Member of Bank of China (BOCHK) group. What does that mean? I’m not too sure either, but when walking in, the teller gave me the exact same checklist and brochure as Bank of China. Even on the bottom of the checklist pages (in the footer) was the Bank of China signature text.

The fees and everything else was exactly the same.

The banker asked me why I wanted to apply. I told her I have HSBC already but looking to have a second bank account to give clients different banking options to pay me with. She had a look of confusion on why I would want another bank account if I already have an HSBC. She didn’t say it, but I felt that she was saying I should just be happy I have an HSBC account and skip applying there.

I thanked her for her time and the information and left the bank.

Leave your review and experience dealing with Nanyang Commercial Bank at the GFAVIP membership.

Svenska Handelsbanken AB

This is a Swedish bank with operations in Hong Kong. I didn’t go to their branch office, but instead made a phone call.

The contact my friend gave me was out for the day, and they took down my name and number to give me a call back.

Within 20 minutes they called back (awesome!) and asked me a few questions about what I was looking for.

After answering (based on the criteria in this guide), she said they can’t help me. They are a branch office for companies with accounts in Sweden, Norway, Finland, and other Norwegian locations.

She gave me a contact to an agency who could potentially help me get introduced to the right banks in HK, and followed up with an email.

Nice, but as they say, no cigar!

Leave your review and experience dealing with Svenska Handelsbanken AB in private members area.

Bank of America (HK)

After a lot of feedback from this article, as well as our newer FATCA problems infographic, I’ve had some USA CPAs tell me to go to an American bank in Hong Kong, specifically Bank of America.

They only do commercial banking here, which could work for us in the small business department. Called up their HK contact us hotline at 2847 6111 and asked for commercial banking. Was transferred through – no hold time!

The woman was nice but said they don’t do new accounts in Hong Kong. That I need a commercial account in USA. I told her I don’t have a commercial account in USA for this HK limited, but I have a personal account in USA. She said it has to be a commercial account. She called it a referral, by having an account in another country where Bank of America is.

Seems back in 2010 they had a branch here, but when China Construction deal happened they moved everything to them.

So a dead end.

Leave your review and experience dealing with Bank of America in a private membership area.

Banks I Still Have Yet To Visit

I wanted to get this guide online as soon as possible. It took me two full days to gather the banks I have already covered above, way more time than I expected. Over time I will visit these banks below and gather more details and information.

On top of adding more information on the banks below, I’ll also try to maintain the banks above information. Still, just a quick disclaimer. I’m doing this guide to help you out – but please do your own homework and due diligence before applying!

ICICI Bank

I have no idea how to pronounce this bank name – luckily this is a text guide and not an audio podcast! I’ll ask them when I visit.

Leave your review and experience dealing with ICICI Bank with other successful hard working business owners.

BEA (Bank of East Asia)

Friends have told me this is a tough one to get approved for. And if you’re approved, the minimum balance requirements are quite high.

Update Nov 17, 2015: So I made it to BEA finally! I’m exhausted with all these banks so took some time to get energy to visit a new one!

Walked into one in Kowloon side. It was rather quiet (as opposed to the normal insanity). Only about 5 – 6 customers in queue instead of the normal mania at most banks here these days.

They had me wait in the business banking section, and only had 1 person in line ahead of me. After about 10 minutes, the banker invited me into his office. I explained I wanted a business bank account, he asked me if it was for a Hong Kong domestic limited company, I said yes. He printed out a few pages for me. I’ll type them out here:

BEA (Bank of East Asia) Documents Required to Open Corporate Account

Limited company, Incorporated in Hong Kong

1. Valid Business Registration Certificate

2. Certificate of Incorporation

3. Memorandum and Articles of Association

4. Minutes and Resolution of the Board of Directors to open an account (they have a template)

5. Latest Annual return Form (NAR1) if company is over 1 year old.

6. Organization chart (if applicable)

7. Banker’s reference (required!) from a Hong Kong bank – business or personal account.

8. Documents from directors (at least 2 directors including managing director):

8a: Identification documents

8b: Residential proof (utility, phone, government form within 3 months)

8c: Nationality proof (passport (for non HK Permanent ID card holders)

8d: Permanent address proof (if different from residential address)

8e: Banker’s reference

9: All director’s identification information (name, ID number, and type)

He asked me if I was a new registered company, which he assumed right away (I do look pretty young). So by having a company less than a year old I can skip some of the required documents like annual return.

I mentioned I am American, and he said oh, they are not accepting American clients now. He said that the US regulators talked to them and said they have to do a lot of paperwork. This guy was nice and open to me – he explained that there are some US clients who have been waiting 6 months for an account and it is still pending.

I was a bit disappointed, so he said that if I’d like to try, I can bring my W-9 form in filled out already. But he just said it would be a lot of work.

I don’t want him to get in trouble so I won’t share his name – but he was nice! He explained there is a list of high risk countries that the bank doesn’t do business with because of political reasons. It was a bit funny he mentioned that after he said they don’t accept Americans anymore. USA wasn’t on the list – but I am starting to imagine it being on the list soon.

I asked how can I get a bank letter of reference from a Hong Kong bank if I am a new business and I’m new to Hong Kong. He said this is what his management makes him do. That it is getting harder and harder. He asked me if I can find other banks that are easy. He was asking me which banks I think are the easiest now – that other clients tell him all the banks in Hong Kong are getting harder.

Since he was more open with me, I opened up with him. I explained that I have visited over 15 banks in the past few weeks and am doing research. Then he asked me what my business was. When I mentioned accounting, he said that is a high risk business and this bank won’t accept accountant firms. Wow! He said they verify the business by looking at transactions in the business, not just the invoices.

While I wasn’t too happy with the results, he was open to me trying to apply. The bank account minimum balance is one of the lowest I have found with 10,000 HKD minimum to avoid the 100 HKD monthly fee.

Another thing to note! During the conversation, he said new bank accounts cannot receive T/Ts (telegraphic transfers!). At least not for the first 3 months the account. So for those reading – this is for the most part not useable if you live outside of Hong Kong. The account is only useful for domestic HK business until 3 months pass.

Leave your review and experience dealing with Bank of East Asia with special business owners in private.

Bank of Communication

On my list. Almost walked into one during my trip but just too tight for time.

Leave your review and experience dealing with Bank of Communication in a private area.

Hang Seng

Have gone to this bank a few times with clients I’m working with. I have to confirm, but a couple months ago they asked for a non-refundable application fee of 1,000 HKD! The client had no interest in giving them this fee without the slightest hint he would have a chance to get the account approved.

The banker explained they charge this non-refundable fee because the heavy amount of paperwork they are now required to fill out. That it costs the bank a high administration fee. She also explained she couldn’t give idea if they could approve his application as the process in the back office. Further she said that the bank no longer tells people what to prepare. This is because there have been cases of applicants fabricating documents to pass these requirements.

Crazy right?

Obviously this left a bad taste in our mouth and has given me hesitation to apply.

Leave your review and experience dealing with Hang Seng Bank and connect with top executives.

Standard Chartered

I have worked with a client to apply here back in the early summer. They were professional and helpful. No application fee. But the minimum monthly requirements was 300,000 HKD else a 200 HKD fee. Quite high and the client said even if approved for this bank he may not keep it open too long.

Leave your review and experience dealing with Standard Chartered Bank with our GFAVIP members.

ANZ: Australia and New Zealand Banking

A few people have told me to check out ANZ. It is on my shortlist and I will check out this bank. I just worry that if its headquarters is in Australia they may not help local companies in Hong Kong.

Told to check out their website anz.com/hongkong. Stay tuned, or if you’re awesome enough you can check up and let us know! 🙂

A New Online Bank Option – Neat HK

At GFA – we are committed to help you find the best financial services for your business. We were approached by a FinTech startup in HK – Neat – and have a full blog post on their solution – read the blog post on Neat HK business banking solution.

Common Trends When Visiting These Banks

So there you have it. Did I miss any banks? Let me know!

What common trends did you see?

Some things that definitely help for some banks and are:

Introductions / Referrals

Knowing an existing client at the bank seems to get certain bankers to “perk up their ears” and pay more attention to you. Others require this referral. And some banks seem to don’t care at all (HSBC).

HKID (Hong Kong ID)

Having a Hong Kong Identification Card, with permanent status (there are various levels of a HKID) is definitely a help when applying. Maybe this is because they see the applicant as more legitimate. Some banks stated it was due to new regulations. Others didn’t seem to ask and just had a policy for passport holders as well.

Company Age

There was some different requirements needed if your company was over a year old. Not sure if it is more helpful if your bank is older or not. Some of my friends tell me they had the bank tell them their company should be 2 years old before applying (HSBC told him). Nevertheless, there are some differences in applying depending on your company being over or under 1 year old.

Basic Checklist For Opening A Business Bank Account in Hong Kong

So you’re probably overwhelmed with this extensive guide, right? Well, from my writing it up, I have found there to be a few basic trends in the company bank account checklist:

Which Banks Did I Like?

After all this, the 2 jam packed days hustling between banks, which ones stood out? Well, I’m not sure if it’s fair to be honest. It also depends on the luck of the draw with the customer service rep and also how I acted in each situation.

But to not be a cop-out, here are a few that stuck out to me:

HSBC – while I know the bank account applications are hard to get approved now, it is so professional and high class.

Citibank – wasn’t expecting to put this one here, but they were so nice at the branch. Others have also said they have great customer service.

Shanghai Commercial – they were nice, well, after I told them I knew someone that already had an account.

Maybe if I told all the banks I knew someone who had an account they would treat me nicer. This is another reason I feel it’s not fair to pick my favorites. I based the three above more their customer service and clear documentation than anything else.

Another Option – Remittance Services in Asia

You can also consider doing remittances instead of a dedicated bank account in Asia. We have a Remittance Partner Recommendation – GoRemit is a leading cross border payment service in South East Asia, Hong Kong and Greater China. With our independent end to end payment network, GoRemit delivers payment within the same business day with competitive, fair and transparent FX rate. Check out GoRemit today

Want To Go Out On Your Own?

I wish you the best, and here again is the list you can use to keep track of which banks you’re working on getting an interview with:

What Are Your Experiences?

Now it’s your turn! Please leave a comment below and share with us your own experiences. I hope this guide is full of amazing experiences and tips and warnings. Let’s all work together to make it easier to get a business bank account in Hong Kong!

Doing business with a HK company is great, let’s try our best to let more and more new business owners get the same experience.

Cheers, and good luck to all!

Banking Situation 2019

We received this letter from a blog reader asking for some recommendations on where to go after being pushed out of HSBC.

MikeHope you are doing well in Thailand! I need to get there one day

HSBC in HK finally pushed me out of their bank. Even though I was dutifully filling out their mountains of paperwork they basically told me to go elsewhere late last year.

It wasn’t a big deal as the main reason for doing it was I was doing a lot of sourcing for some other companies and that business dried up for a while.

Well, it looks like 2020 will be another big year for that part of my business. With the tariffs, people are now asking for help offshoring some of their stuff to Vietnam or Indonesia where I have a few contacts.

Wondering if you could help with a direction I could turn to for my HK Company for banking?

You and I have met, so you know I’m just a regular guy. That is why I really was attracted to your podcast from the beginning, because I could tell you were like me. Not pretentious.

Anyways, it looks like you are doing very well in your businesses. Hope your meetup in GZ goes well!

I’m trying to plan a trip but it looks like September instead of October for my fall trip. Hope HK calms down by then!

Mike’s Answer:Hi,

Yes, sad to say but more and more people are getting the “letter of death” from HSBC. Maybe if it isn’t used much or the bank isn’t making much money off fees, they feel it is more of a liability than an asset on their company books.

As for other banks, we are a partner with a CPA firm Unipro Consulting and can offer a service to arrange a bank appointment and other help for a fixed fee, and if isn’t successful we refund all except a $100usd processing fee, but if it is successful the fee remains. You can contact us for more information – because it is a bit of a constantly changing service we don’t have a clear sales page online to review and you need to speak to a customer success representative at Unipro. Contact us today and ask for help

Banking Situation 2018

I’m always setting up bank accounts here in Hong Kong for redundancy reasons [removed part] Have done the same thing that you’re talking about… walking around trying to get a bank account. If you’re not going to receive a referral to the bank, I’ve seen the most success with doing everything via e-mail/phone first (directly with the RM) and then going in for a follow up about the application.It’s definitely become a lot harder to open up bank accounts in Hong Kong!

Thanks for writing this all down – it’s really helpful.Cheers, Yanni

Come Truly Prepared With Our Complete Guide

Not messing around, are we? Then you made the right choice by investing in our Hong Kong Supercharged program to ensure you have everything you need for your Hong Kong banking and business experience.

Hong Kong Business Supercharged

The ultimate business guide for researching, setting up, banking, upkeep, taxes, growth, and more.

86 Comments on “Applying To Hong Kong Banks? Results After Visiting 20 in 2 days (As an American Entrepreneur)”

Thank you for providing such an insightful and informative post!

Regarding HSBC – “Documents Required from 2 Directors” – is that only the case if there are multiple directors then at least 2 directors are required? I presume solo director company applicants are still fine?

Also, I noticed in your post that both HSBC and Wing Lung list BVI applicant requirements. Just out of curiosity, did any of the other banks happen to mention (or list in their info guides) whether non-HK companies were supported for opening business accounts?

Last time I was there, I got mixed answers from HSBC and ‘no’ from virtually everyone else when it came to the non-HK company question. Seems like the majority of HK banks want nothing to do with non-HK businesses, which is a shame given HK’s prestige as the premier offshore banking jurisdiction..

H John,

Glad you enjoyed this post! Trying to bring clarity in such a confusing topic with “muddy waters” – let’s see where it takes us!

Yes, I also was noticing BVI as I was transcribing those application list forms….I didn’t verbally ask them about offshore or BVI in person. Yet, sadly as you mention it is getting harder and harder for offshore companies to get bank accounts in HK.

I’ll see HSBC early next week and will ask them for ya 😉 stay tuned.

Pingback: Announcing: US Citizens Will Notice Increased Pricing

I currently have a HSBC account, and would like to have one other bank account in HK for the same HK company. I opened the company in June and planning a trip to HK in two weeks. Can you recommend which other bank would be a good option? And would HSBC be an option to open a second account for the same company?

Hi Doug,

HSBC you can open a second account, and they make you apply from scratch again. So if I were you, I’d apply to other banks – so that you can “hedge” a bit depending on what the future holds for all these banks.

For now, other banks on my list are Hang Seng (but they have been implementing upfront fees), and Citibank.

In HK in 2 weeks? We are having a get together about that time – if you’re in town and able would be cool to see you there – https://www.globalfromasia.com/officeopening/

Michael,

Thanks for the information. I will see about making an appointment with Citi.

I stated two weeks, but actually my flight out is this coming Friday. I head back on the 23rd and while I would love to attend the party, have to get home to get rested up for Thanksgiving.

I do want to say that I love the podcast, it has helped tremendously in my business.

hey Doug,

So happy to hear you love the podcast – really inspires me to keep pushing on this!

I’m starting to offer full service assistance for people with opening HK business bank accounts, would love your feedback on the service – maybe we chat when you’re in HK? I’m here Mondays to Wednesdays nowadays.

Michael,

I will be in HK from 15th to 16th. Have a appointment with HSBC the afternoon of the 16th. Looks like your office is right down the street from the Hotel I usually stay at (Holiday Inn Global Mile), maybe I could stop by to see you that morning?

My email is doug at rdasolutions dot net send an email with your wechat and we can connect there

sounds like a plan 🙂

Hi Michael!

Nice post! I’m being asked for an introducer at Shanghai Commercial Bank before they can help for the opening. Do you have one I can use? Thank you in advance!

Kelly

hi Kelly,

Yes, need an introduction – let me send you a private email. Introductions I need to speak to you about your business and get to know you a bit – else it can come back to “bite me”!

Mike

Michael,

Public Bank is originally from Malaysia and while DBS Bank is from Singapore by the way.

Cool, thanks for the info!

Visited some Citibank branches and got the impression that they don’t have experience dealing with foreign companies nor offer good service to smaller companies in general. I see no reason to use them over HSBC, BOC, Hang Seng etc.

Guess it depends who in Citibank you talk to – which branches did you go to?

The two branches with “Citibusiness” in Central and the branch in Sheung Shui. All were small, had no special business section as far as I could see and required some sort of Hong Kong presence. Either that you be a resident, that the company operates out of Hong Kong and/or that you come back later for more questions.

This is definitely true nowadays – Citibank keeps telling me they want a “real office” in HK – sometimes even saying a site visit maybe necessary…

Pingback: Can You Apply For A HK Bank Account Online?

I am just wondering if HSBC keeps a record of companies with rejected bank account opening application because I would really like to try it again after getting a rejection some time ago. The question is whether the bank will reject my new application straight away or it is still possible…

hi Toni,

Thanks for your question. This is a hot topic – as I do get a lot of emails from people who were rejected from HSBC. There isn’t a hard and fast answer, I have talked to about 10 reps , and gotten a variation of 10 answers.

But the answer here I am most comfortable to say publicly on this blog:

Yes, you can re-apply. If your case changes significantly. Probably would wait at least 1 year. Show the growth and updates in your company. And of course, pay the application fee again without refund ability.

Good luck, and if I can help you with the service, let me know! Regardless I wish you the best!

Mike

Hi Michael,

thank you for this awesome post.

I have an Off-shore company in HK. I sell self-help products in german language on my website. I registered the company only a month ago, but I am making profits since 2014 (with the company registered in Germany).

I applied already for a business account at HSCB but the denied it.

Any idea which bank I could get a corporate account? I have an online business making profits but it is not related to Asia or HK and I don have a HK ID.

Thanks!

hi Anchu,

So sorry to hear you were rejected for your application at HSBC HK. I am trying my best to talk to them and others in HK government about this tightening up – seriously getting more and more requests each day from people getting denied – so don’t think its just you.

Really they want to see more Asia / HK relevancy to the business model I believe. Where are you based and working from?

Hi Michael,

yes, I heard that too. My cousine is working for a companies which offers company registration services in HK. They just got the unofficial information that HSBC is now only considering applications from businesses with at least 500k turnover…

I am a digital nomad, so no fix country where I am working from. My website is in german and all my profits are 100% made online.

Do you have any idea with which bank I have a chance to get an account? As I said, I have no business relation to HK and no HK ID card…

Thanks for your help, I really appreciate it.

Hi Anchu,

Yes, totally understand – this is why we just made a new system – a survey system – to help match you with the right bank – do you mind filling out the survey at :

https://secure.globalfromasia.com/hksurvey/

then we can learn more how to help you!

cheers and all the best

Mike

wow super well done sooo impressively detailed 🙂 great for the new generations in business here in china and all over asia … keep growing … #fromchinawithlove

Hey Mar!

So happy to know you and thanks for the great comment! Funny we bumped into each other at HSBC HK that day! Hpe your account is in good standing 🙂

Valuable suggestions – Coincidentally , if anyone needs a a form , my friend found a sample version here

https://goo.gl/f3qKzf.Pingback: Border Hop Between Hong Kong & China (A Day in the Life)

Hi Michael,

Really detailed awesome post. Any idea if I can have any problem trying to open a personal account in HK without HKID, but with proof of residence?

Hi Ruben,

The question they normally asked me was if I have a HKID – not if I live in HK. Of course you can explain you are in the process of getting a Hong Kong Identification card, its worth a shot.

Basically – since I wrote this post – banks have gotten even harder. But please share your experience here so we can all learn how it is currently as it is changing often.

Best of luck.

Mike

Michael:

How are you? Great post, very good info, congrats! Our business has been operating in USA for 8 years and our revenue is around 1.5 to 2 million USD a year. It is a promotional items business and 80% of our sourcing we have done it in China since we started. Now our customers required us to have a company in China, so we opened a company in Hong Kong 2 weeks ago that is realted to the USA business. I will be in HK this monday sep 12th since we have an appointment with HSBC for bank account opening. We have appointed a Chinese national from Ningno as managing director and he is also going to the bank appointent and we have all required documentation. I would like to connect with you since we need a plan B and C in case HSBC declines ( we hope not). Can you help? Send me your email so we can get connected during this weekend. I am ariving to HK sunday night

Hi Mike,

Great article. We stumbled across this when we were in the process of obtaining a bank account for our newly established HK company.

We ended up opening an account with OCBC Singapore (October 2016). FATCA has definitely made it a lot more difficult for U.S. citizens to open foreign bank accounts, especially in HK. Many HK banks as of today require an office visit. There are a couple of reputable companies in HK that will assist you in setting this up and passing the office visit test. The price for this service, $5k USD. Not cheap, but it’s guaranteed or your money back.

This option is probably best suited for individuals who cannot meet the documentation requirement (proof of business activity, bills of lading, foreign company evidence, etc.)

As a result of the FATCA regulation that has made it expensive for banks to take on U.S. clients, they have pretty much responded by upping the deposit requirements.

We were required by OCBC Singapore to deposit $35k USD per currency account. We opened HKD and USD accounts, so our initial deposit was $70k USD just to open the account.

In other words, opening an offshore account for your HK company is not impossible for U.S. citzens. It’s just going to require a large up front deposit.

Thanks again for such a great post.

Hi Charlie,

Great to hear about your success with OCBC Singapore. Just to confirm, was that using your HK corp, or was a local Singaporean corp needed?

Hi David,

We opened the Singapore account for our HK company. No local Singapore corp is needed.

We used a company called Intercorp in HK. They have an office in Wan Chai, so you can go and visit them and discuss your needs. They have a relationship with that particular bank branch in Singapore, so the business account manager was able to approve us before we flew over there.

We paid Intercorp around $1,200 USD or so for company setup, first audit, etc. and for setting up the account with OCBC. They did all of the leg work. We just had to show up to sign all the docs with the bank in Singapore. We walked out of the meeting with our key FOB’s for online banking that day.

I might add that we do have a U.S. based corporation, and our revenues are in the low 7 figures, and we manufacture in mainland China. Not sure how difficult it would be for brand new businesses with no related foreign company.

All the best.

Hi,

Let me give an update on this topic.

I recently started a company in HK and visited HK to apply for a bank account. I have visited them all. So for those who are wondering, will I have a shot, you will but your chances are pretty low. Especially if you use the same setup as me. Having a virtual office and company as secretary. All is legal, but just not what the bank wants. So its like buying a car, without wheels.

As HSBC is recommended in this article, I would like to let you know that I agree. Very professional, but there is a catch. HSBC will setup an appointment with you. At the meeting you will have the chance to explain what you do, how you do it and then been asked to pay 1200 HKD for you application. I agreed to it, because I needed a bankaccount. This fee was not matter the result non-refundable. Meaning that if you don’t get the account, you won’t get your money back. And it was only after I visited the other banks, I realised I would lose my money. And yes, I got denied ( no explanation given).

Im still waiting for two other banks to approve ( or deny ).

So if you are in the same boat as me; a non HK resident, setup an business with an agent and have a virtual office and a business less than one year. Please avoid HSBC.

Hey Henry, thanks for the update! Any news on this? Did you get accepted by another bank?

It took 3.5 months for the OSBC bank to deny my application today. Standard Charted bank is still in process. The downside to this bank is the high deposit (200.000 hkd). Still 100.000 HKD less than OSBC wanted from me ( 300.000 initial deposit ).

My conclusions about opening a HK based company with an HK bank is kind of a unicorn ( for the smaller players who want to benefit from HK advantages). No bank accepts virtual offices ( the banks compliance teams have a list with virtual offices, once the office is on that list you will be denied. This was explained to me by one of the bank relationship managers), no bank accepts companies with single foreigns directors even if you have a EU passport ( how can you operate a company if you don’t live here, don’t produce here, why do you need HK?). So if you want to setup an company in HK, you will need a solid company foundation with proven business in HK. Without this, honestly your waisting your time believing it will work. I incorporated in augustus 2016, 6 months of passed and nothing will happend. I have one chance left, but I don’t think this will work. One banker gave me an idea. She asked ” do you have proven records” I said yes, from my previous business. She said, no we need from this business” How can you do business without a bankaccount? You can’t. So you ll have to think outside box. Open a bankaccount for example in Singapore ( high fees though) and operate this way. Downside to this is for e-commerce people that depend on Paypal. You won’t be able to, well yes you will be able to open an account, but I guarantee you will be limited. Hope this information will help others making a decision in choosing HK as a bas.

Hi Henry,

So sorry to read this painful experience – yes Hong Kong has changed to the extreme since I first started this blog and wrote this blog post. I guess they don’t want entrepreneurs here anymore, it is really a disaster.

Hey Henry,

Any update? And is there anyway to contact you directly? I have a similar painful situation like you

Pingback: What To Do Before You Go To The Bank Application

Thank you for this article, its very helpful. We’ve been through the ringer as well with rejection after rejection, and now considering offshore banks. Just FYI- I contacted our Bank of America RM in the US, and you need to at least US $20 million in revenues before they can refer you to the HK branch. Tough to meet for our start up.

Hi Burt,

Glad the blog post helped. unfortunately the world is going more and more to the rich get richer – and banks jus want to deal with big companies more than ever – and try to force us to stay where we were born to do business. Crazy isn’t it?

Here’s my (mostly bad) Hong Kong experience:

– I registered my company through Jumpstart in February 2016. Excellent service, EXCEPT the banking side of things…They scheduled me an appointment at HSBC, they sent my company papers directly to the bank but offered me no guidance on the process. My trip to Hong Kong & HSBC was a complete waste of time and money (the bank took almost 2 months to process & deny my account opening)

– After trying another bank – and 5 months – I finally succumbed and paid a tiny consultancy company ( hongkongtaxfree.com, or Accoplus Ltd ) 10,000 HKD to help me with the bank opening. They worked very diligently, accompanied me to a bank opening at OCBC Wing Hang Bank and I finally managed to open account in Hong Kong with their help.

– However, now a BIG WARNING: OCBC Wing Hang is the most useless bank I have ever encountered! I have had the account for 6 months now and I have been unable to transfer or withdraw any money from my company account. Their internet banking just doesn’t work, or some other aspect always goes wrong…I am traveling to Hong Kong next month to sort out my banking mess in person.

HI HArry, did you succeed? What has happened? Thanks in advance, Oliver

I’ve had similar experience and also had to fly back to Hong Kong to make transfers and said it will take 6 months to get internet banking!!!!!! What is wrong with Hong Kong its madness

Hi Harry,

HSBC HK has just rejected my application this week (March 2018) after 8 months never ending business proofs submittals.

My consultant in HK -who helped me setup the HK incorporated in 2017- has just suggested to try now opening the business bank account with OCBC Wing Hang. After reading your post I am concerned whether its internet banking still useless.

Would be great to hear recent experiences from others dealing with OCBC Wing Hang.

Thanks,

Topo (EU citizen)

Hi Michael,

My partner and I we are both citizens from Argentina. We have an 18months old company registered in the United Kingdom (LLP). We have customers all over Europe and in HK as well, reason why we would like to open an account there. To make payments easier… We may receive around 300K EUR from these HK customers per month. What are your feelings, which banks should I get in contact with? Regards!