Looking to sell in China? Wondering about all the complications of importing, duties, taxes, corporate structure, logistics. The list goes on and on. In today’s guide book, we are going to tackle this problem to give you a clear overview of the process with recommendations on how you can structure your global empire and include China in this map!

Would you like the Presentation Guide and Overview? Click below:

The Beginnings of Cross Border E-Commerce

While we may dig back earlier, the industry likes to credit eBay as the pioneer in cross border e-commerce. They entered the market in 2004 with the goal of capturing the domestic Chinese e-commerce market. Jack Ma and Alibaba took care of them with TaoBao, and eBay eventually retreated from its campaign. But they didn’t leave completely.

In 2006, eBay announced they were exiting the domestic China e-commerce market, but eBay.cn remained.

What is it used for?

A platform to help Chinese sellers to sell in the West, on Ebay in USA and other international markets. You can take a look at it now and see for yourself. Here we have a screenshot of a Google translation of the homepage:

The 2008 Milk Powder Scandal

Most of us remember reading the news about the Chinese made baby powder formula that was contaminated. We all know about Chinese product quality issues, but no one could imagine it could even creep into consumable baby food products! The Chinese consumers were outraged and lost all trust for domestic Chinese brands of baby powder.

So 2008 marks the year that the Chinese started to be serious about buying overseas brands and goods. It wasn’t about price anymore, it was about trust and quality.

Smuggling iPhones

The world has been converted to Apple fanboys. And the Chinese consumers are part of that fanfare. American friends of mine were always confused to know why Chinese would to go USA to buy an iPhone, wasn’t it made in China? Wouldn’t it be cheaper in China?

Nope.

iPhones and many other electronics and premium goods are cheaper outside of China. Not because of the manufactured cost – but instead due to the VAT taxes and other taxes the Chinese government puts on its goods.

iPhone 4 was the model where the insanity was put in the limelight. Smugglers were taping multiple iPhones around their body and walking them across the Hong Kong and Shenzhen border. To avoid taxes, and to sell them for a premium in China.

These smugglers got the nickname “Hai Tao”.

The Evolving Chinese Consumer

So in the late 2000s and early 2010s, the Chinese consumer started to learn about these quality and tax differences with products around the world. With a growing Chinese middle class with discretionary income, combined with the power of the internet and social media, secrets got out. And the Chinese consumer emerged around the world.

Welcome to the world of cross border e-commerce!

The Problems With Smuggled Goods

So, while it is intriguing to discuss the notion of armies of humans crossing a land border to bring goods into a rather restricted market, let’s discuss the downsides in the marketplace:

Is it really authentic? Just because this smuggler network tells you it is real, how do you really know? Maybe they are starting to replace the authentic ones with fake ones in the supply chain.

Potential risk of paying taxes – you may get away with this for a while, but there will be chances you need to pay taxes on these goods in order to pick them up.

No refunds – if you buy something outside of China, even if it was legit and from the store, you need to bring it back where it was purchased! And do you have the original receipt (and packaging) – probably not!

So while using this Hai Tao network may work for small scale, if you want to build a stable business on top of this supply chain, you are at grave danger.

Emergence of Free Trade Zones

So, the Chinese government was watching this growing industry over the years. While they strongly discouraged the Chinese people from doing it, the smuggling continued. The response was a new kind of importing, via a new network of approved Free Trade Zones (FTZ).

In early 2014, Chinese Customs Department announced Cross border Free Trade Zones, with 7 policies on how they would operate, in the following areas:

深圳(Shenzhen)

天津(Tianjin)

上海(Shanghai)

杭州(Hangzhou)

重庆(Chongqing)

合肥(Hefei)

郑州(Zhengzhou)

广州(Guangzhou)

成都(Chengdu)

大连(Dalian)

宁波(Ningbo)

青岛(Qingdao)

苏州(Suzhou)

福州(Fuzhou)

平潭(Pingtan)

These free trade zones were setup to make it easier for foreign goods to be imported into China. So that they can then be classified (if new products) and taxed to encourage businesses to do things the legal way. But not only for import, for export as well – goods could be shipped here, warehoused, consolidated with foreign goods, and shipped out to new destinations.

To me, personally, this is also a move to be more of an open system, and a bit of a competitive edge against Hong Kong’s advantages as a free trade port.

Opening of the Free Trade Zones

Actually these free trade zones were under construction for many years before they were publicly announced in early 2014, giving them a head start for their opening a couple years later.

Hangzhou was the first to open (home of Alibaba) with its opening in 2015.

And in 2016, many new FTZ started to debate: Shenzhen (Qianhai), Tianjin, Shanghai, Chongqing, Hefei, Zhengzhou, Guangzhou, Chengdu, Dalian, Ningbo, Qingdao, Suzhou

Which Free Trade Zone is Right for You?

Now, I know what you are thinking. What is the best city for me to choose to establish my business and my logistics center? Good question. The way these policies was setup, each FTZ is independently run by the local government. Over the years I have learned that they have very different policies and incentives.

But this can be an advantage for your business! You can bargain with them and explain you have other opportunities in other FTZ. Talk to a free trade zone specialist to outline the current offers and see what is the best fit for you.

Keep in mind these policies are rapidly developing, as we will see in the next section.

Big Updates in April 2016

As these free trade zones started kicking off, a lot of them started basically extending “Hai Tao” ways inside of Mainland China. They were not declaring the taxes on small shipments, thus avoiding paying Chinese taxes on the goods!

The Chinese government then passed 9 new policies on the free trade zones, which basically made it more restrictive for companies to “slip out” small B2C shipments from the zones to Chinese consumers. The goods are not taxed when they land into these free trade zones, but that doesn’t mean they are never taxed. It is simply delaying the taxes before they reach the Chinese consumer.

So what is Cross Border E-Commerce?

Simply put, we define it as the merging of b2b and b2c. B2B being business to business, and the more traditional large order sizes of say 1,000 MOQ (minimum order quantity) that is then shipped over to another country’s port and then to a new warehouse.

Cross Border e-commerce allows you to send smaller quantity of goods into a foreign country, and ship them B2C (business to consumer) direct to the consumer in that new international market.

Which is perfect for the rather complex and high tax country of Mainland China. You can now take smaller quantity of goods and ship them to China and test the market – even on new and un-classified products for the Chinese market.

Why do governments want and support this cross border e-commerce?

More choices – it gives the people in their country more access to goods. As with traditional B2B, someone would need to by a manufacturing order of goods in order to open a new market, with Cross Border Ecommerce you can send a small run and test the market.

Easier customs flow – governments want to get your taxes and ensure the goods are safe. This gives businesses less excuses for using “underground” methods to get goods into China and other countries.

Smaller order sizes – merchants can now do smaller order sizes and not worry about extra hassles.

Supplier direct to consumer – brand owners have even easier access to selling their goods in new markets and bypassing middlemen.

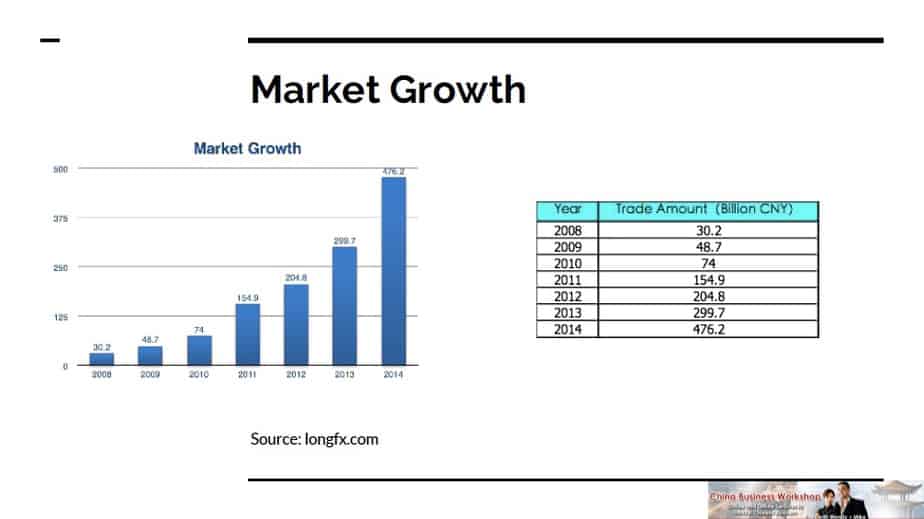

Market Growth of Cross Border E-Commerce

This is still a very young industry, that is growing rapidly.

Let’s Talk Taxes

Ok, now that we have gone through the macro-economic data and theory, let’s talk numbers and taxes.

Please note, this is from the Shenzhen, China FTZ called Qianhai. For each free trade zone, you need to ask for the latest tax policies. From our research, the south region of China does have the more favorable taxes. This is because it is bordering Hong Kong and has more pressure to attract merchants to do things legally rather than smuggling across the border.

Here is a chart of various products that are popular for cross border trade, comparing traditional B2B with B2C cross-border

There are 3 kinds of taxes here:

Taxes: This is the “variable” taxes that the government puts on the goods. Similar to tariff. All countries have these various tax rates depending on the product.

VAT: This is a flat tax, similar to sales tax in USA, except it is paid upfront and later passed onto the consumer. Think of fapiao if you are ever in Chinese shopping malls.

Consumption Tax: This is an additional tax for those goods the Chinese government feels are for more luxury items.

Please note, these tax rates are on different numbers. If you are doing the traditional B2B method, then this is charged on the imported price. Compare that with Cross Border B2C and that is on the selling price to the end consumer. So look at what you are importing it for and compare it with the selling price and calculate the numbers.

Disclaimer: please check with your customs broker for latest rates and regulations – as this is a rapidly changing industry.

Comparing Traditional B2B Duties with Cross Border Duties

Let’s put them up head to head. Here is a chart to refer to:

As you can see, the free trade zone is working hard to make an attractive offer to you. Yet you need to keep in mind, that the rate you are calculating is on two different numbers.

Import value – for B2B, when you are paying the taxes it is calculated on the imported price. When you are doing cross border e-commerce, it is based on the consumer price.

This should make you realize that you need to keep a better idea of what the imported price and the selling price are when calculating. Many times, you may save on the taxes when doing traditional B2B importing, yet you will need to do larger quantities and pay for everything upfront.

Therefore, the main advantage of cross border e-commerce into China is doing smaller quantities, with good speed, and less upfront fees and paperwork.

Many suggest that you would first import the goods by cross border ecommerce, and as your business and volume pick up, you would move to the traditional model.

Importing Term – CIQ

Now to get some definitions and procedures out of the way. When you import you will learn about CIQ, which stands for China Inspection and Quarantine. This is a government department that ensures the products imported and distributed in Mainland China are classified and controlled – for the ultimate safety of the Chinese consumer.

Therefore, to legally sell products in China, the product must be approved and classified with the CIQ.

For a new and innovative product, getting the CIQ can be quite a headache. This is where the advantages of the FTZ can come into play. The process is streamlined, you can ship an initial run of goods to a free trade zone, and then have it expedited in the CIQ registration.

How does the process work? Once the goods are in the free trade zone, you can apply for a CIQ on the product(s). Before you can apply, you will need to register your company with the CIQ department. This is done at beian.miit.gov.cn and a fairly straight forward process.

Once your company is registered, you can upload your product list (via an excel template) as well as your product photos. Once all the information has been submitted, this can take approximately 5 to 7 business days to be approved.

Much faster than the traditional method, let me tell you! The free trade zones are doing this in an effort to avoid the underground (illegal) methods of smuggling goods. By reducing the time and hassle of doing things legitimately – its discourages business owners from alternative and risky methods.

So What is Customs Looking For?

So once you are registered with the CIQ, when an order is placed, they will want to collect the following three pieces of information:

Order information

This is sent from the online shop or marketplace such as your online store, Taobao, Tmall, Wechat shop etc. It will contain the customer information, contact information, product price, shipping address, etc.

Logistics information

How are these goods being shipped? Which carrier, destination, and expected date of delivery.

Payment information

How were the goods paid for? What was the payment method – wechat pay, alipay, cash, etc.

This is done so that the government can keep track of which goods are sold, to who. They want to control the potential health risks of any imported goods and in case of a recall or other emergency be able to track who bought it and how to reverse the process.

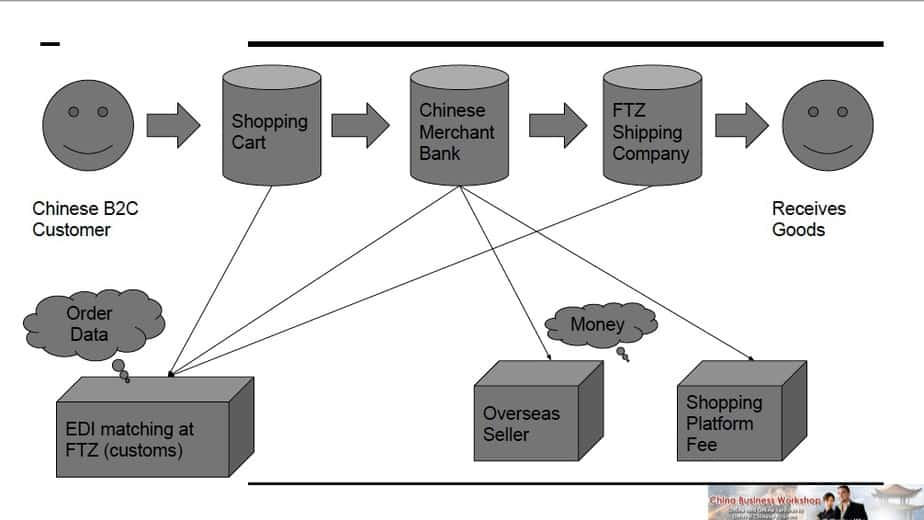

Putting the System Together

So let’s look at the various parts of cross border trade:

Make sense? A lot of steps to get goods into China and to the end consumer’s hand. But once you do this a few times it will be like clockwork.

Flow Chart

Here is a visual we drew up to make it more clear:

Notice how as the order goes through the transaction, each step has to report to the CIQ. This is the critical part of the free trade zone. They want to have proper data of what is being sold, and who is buying it. When you are doing this business, you will have to keep a good relationship and have all your orders accounted for.

When a consumer buys the goods, the three parts of data will be collected (shopping cart, merchant account, and logistics information). Skipping any of these steps is not an option.

There are ways to have a third party business or fulfillment center to receive the money in China for you, and then remit the funds to your overseas bank. They will keep the merchant fees and their fees and then send you the difference. This is a good option for those who want to save the time and hassle of opening a company locally inside Mainland China. It can also be another stage later down the road once you have validated your product in the market.

How the E-Commerce Fulfillment Works

So, have a hot new foreign product and want to get it to the Chinese market? Leveraging a free trade zone is a great start. The question is – do you want to open your own company in China, or use a third party?

It may be a best shot to use a third party fulfillment center in a free trade zone to get the best of both worlds – fast setup as well as streamlined customs processing and payment.

How does it work?

How much does this cost?

Rates vary, but like any third party warehouse around the world, the fees are:

If you would like to work with us, we would very much like to give you a custom quotation. It depends on your product type and monthly volume. Please fill out a RFQ at at our service connection site.

Benefits of Using a Free Trade Zone

Again, it depends on which free trade zone (more are coming on a regular basis) and the current policies. Here are some top level benefits:

Industries They’re Looking For

What kind of businesses do these free trade zones want? The spectrum is pretty wide, and here is a list:

Financial companies – (Though now this is restricted). “Fintech” is a hot keyword in the startup scene around the world. China also wants more exposure to this disruptive industry, yet the regulators have currently throttled the registration of new financial companies (as of writing this guide).

Logistics – of course, a free trade zone needs a lot of logistics service providers. If you are offering these services, they more than welcome you – warehousing, shipping, and technology to these providers.

Information Technology (IT) – All governments and special economic zones want high tech and internet companies there. If you have something new and innovative, they will be looking for you!

Tech services (cross border ecommerce supplier) – The combination of logistics and technology is booming. Placing yourself in the middle of a free trade zone is an attractive offer for both you and the government there.

Professional services – consulting and legal help. The government is growing and so are the companies there. Service providers who can offer soft skills to this rapidly growing industry will get a lot of opportunities here.

Public services (construction, property management) – The free trade zones are construction zones now, literally! Get your hands dirty and take part in this massive construction zone if you are dealing in real estate.

Download my presentation slides – Free

Enjoy this guide? Get the full details of the presentation slides below

3 Comments on “Curious About Cross-Border E-commerce Into China? Here’s The Definitive Guide”

Pingback: 5 Things You Need to Know About China Free Trade Zones (Benefits & More)

I want to know under what category of FTZ is Petrochemical, Manufacturing, Tourism?

Can the Free Trade Zone be used to import US goods without payment of duty, then add Chinese made goods within the zone (perhaps some manufacturing) and then export completed machine out of China without payment of duty?